Writer: Andrea Teran

3 min read April 2024 — In the first quarter of 2024, business leaders across the U.S. South expressed continued optimism about the regional economy, with the latest Capital Analytics Business Sentiment Survey (CABSS) highlighting sustained growth in economic sentiment, revenue expectations, and employment outlook.

3 min read April 2024 — In the first quarter of 2024, business leaders across the U.S. South expressed continued optimism about the regional economy, with the latest Capital Analytics Business Sentiment Survey (CABSS) highlighting sustained growth in economic sentiment, revenue expectations, and employment outlook.

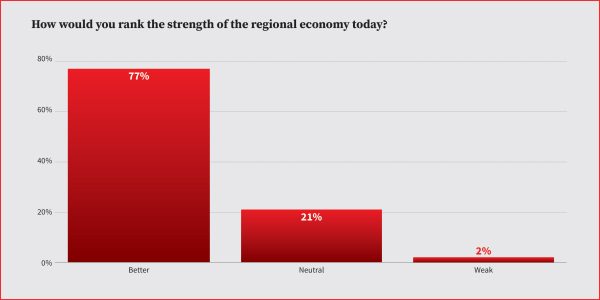

The CABSS for 1Q24 reveals a notable upsurge in regional economic optimism. With 77% of survey participants now viewing their local economy in a more favorable light — an increase of 2% from the previous quarter — the positive sentiment is clear. Specifically, 51% assigned a strong score of 4 out of 5 to the health of their regional economy, and 26% went even further, granting it the highest score of 5. Yet, a sense of caution is detectable with a slight uptick in concern, as 2% of respondents indicate a perception of economic weakness.

Balancing this optimism, regional business leaders are met with the broader challenges of evolving macroeconomic policies. The Federal Reserve’s recent shift from the expected three rate cuts due to persistent inflation to a more tempered forecast signals an economic environment in flux. Atlanta Fed President Raphael Bostic’s suggestion of potentially a single rate cut this year marks a significant recalibration of expectations among the Fed’s policymakers.

Challenges also continue across sectors.

“The hospitality industry is still dealing with and recovering from challenges that include debts incurred over the past few years and a slowdown in consumer spending. Costs have gone up dramatically amid economic uncertainties. Labor costs, rent and more have gotten more expensive,” a president of an advocacy organization in the hospitality industry told Capital Analytics. “On the other end, there has been a tremendous amount of growth.”

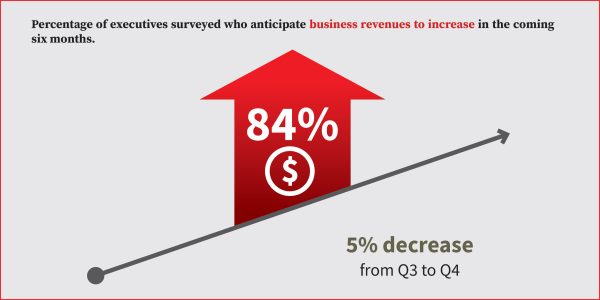

Business leaders are increasingly bullish about their revenue prospects, with 85% anticipating an uptick in earnings, despite a slight 5% dip from 4Q23’s optimistic forecast. This confidence is further indicated by 46% of respondents forecasting a score of 4 out of 5 for their revenue trajectory, and 36% anticipating the highest growth level of 5, showcasing the robust demand driving the Southern economy forward.

Customer demand remains a cornerstone of business confidence, with 90% of executives reporting an increase over the past six months. This surge aligns with the proactive business strategies observed across the region, suggesting that companies are not only meeting but potentially exceeding market expectations.

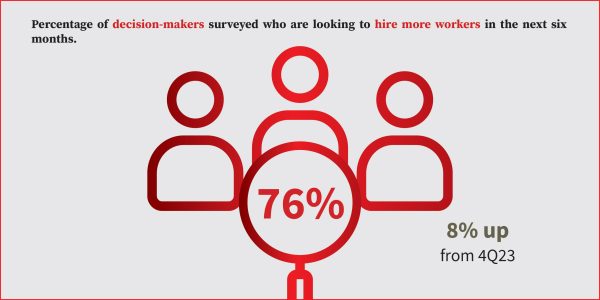

The CABSS survey also unveils an intriguing trend in employment, with 76% of respondents gearing up to expand their workforce, an 8% uptick from 4Q23. The determination to hire is particularly strong, evidenced by 59% of leaders who are aggressively looking to add to their teams (rating of 5). This reflects a proactive approach to capturing market opportunities and addressing skill gaps in a competitive landscape.

President Joe Biden and Fed Chair Jerome Powell have recently highlighted the sustained robustness of job growth, with the unemployment rate remaining below 4% for an historically unprecedented period. The labor market’s vitality is also emphasized by consistent hiring across various sectors, a trend that has remained steady despite some sectors showing signs of layoffs. Powell, reinforcing this sentiment, has characterized the job market as in “good shape,” as cited by CNBC, noting the absence of significant weaknesses that could indicate a downturn.

“There has been a positive trend in our business, with the increasing need for more attorneys reflecting our expanding client base,” said a Raleigh Durham law firm CEO.

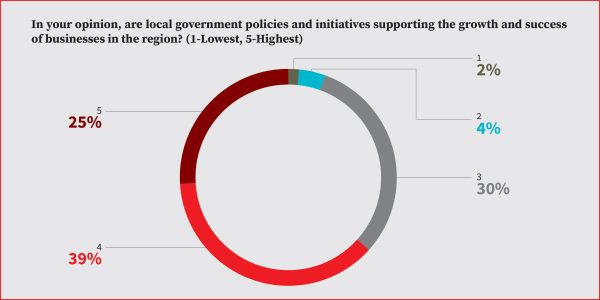

The perception of government support, however, presents a mixed bag, with 63% of respondents acknowledging some level of positive impact. However, the varied scores indicate room for improvement in policy formulation and implementation to better cater to the needs of the business community. Despite the optimistic tide, companies remain vigilant, navigating through the complexities of cost management and strategic planning in a dynamic economic landscape.

“I look to our civic and state leaders, what their role is, and how we can help. We have a lot of great relationships with community members, and we want to honor those in our work and remain intentional in our approach.” a principal of an architecture and engineering firm in Nashville told Capital Analytics.

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.