Writer: Jerrica DuBois

3 min read April 2024 — Private and public sector leaders in the U.S. Northern markets covered by Capital Analytics’ annual business reviews demonstrated a positive turnaround in economic sentiment in 1Q24. The first quarter of the year saw the Federal Reserve continue its pause on interest rate hikes after raising them 11 times in 2022 and 2023. Although inflation, sitting at 3.2%, is still above the Fed’s target of 2%, business leaders in the North have become more comfortable in the current economic environment.

3 min read April 2024 — Private and public sector leaders in the U.S. Northern markets covered by Capital Analytics’ annual business reviews demonstrated a positive turnaround in economic sentiment in 1Q24. The first quarter of the year saw the Federal Reserve continue its pause on interest rate hikes after raising them 11 times in 2022 and 2023. Although inflation, sitting at 3.2%, is still above the Fed’s target of 2%, business leaders in the North have become more comfortable in the current economic environment.

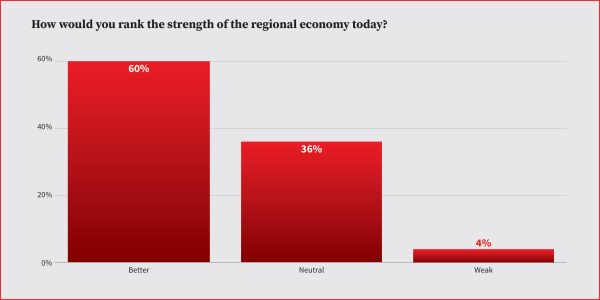

In the latest survey of public and private sector leaders, the Capital Analytics Business Sentiment Survey (CABSS) for 1Q24 found overall business sentiment improving from the previous quarter. Compared to 4Q23, there was an 11% boost among survey respondents viewing their regional economy in a positive light, increasing from 49% to 60%. Thirty-six percent of respondents viewed their regional economy in a neutral light.

Over the January to March period, those surveyed shared their sentiment from a rating scale of 1 to 5 (5 being the highest). The average score among total respondents was 3.62 out of 5.

The macroeconomic changes in the market impacted businesses across all sectors, whether it be inflation, interest rates or labor challenges. Some industries fared better than others, but overall most have weathered the headwinds and are on a steady, stable path moving forward.

“Fortunately, our industry has navigated the inflationary challenges quite well,” an energy industry executive told Capital Analytics. “The energy sector has been able to continue investing, thanks to healthy balance sheets. This period has allowed for significant investment in R&D and renewables, marking it a fruitful era for the energy industry. However, the consumer side has faced difficulties with increased electric and natural gas bills, a challenge we hope will diminish in the coming years.”

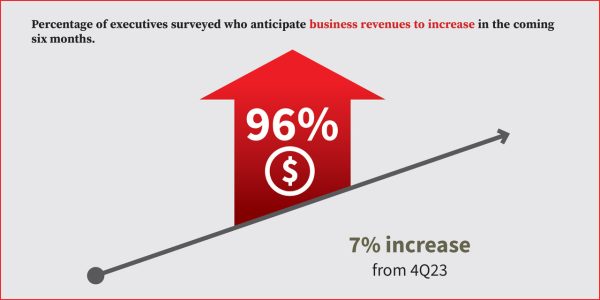

In the Northern markets, business leaders remained positive on future revenue growth. Ninety-six percent of those surveyed expect business revenues to increase in the coming six months — a 7% increase from 4Q23.

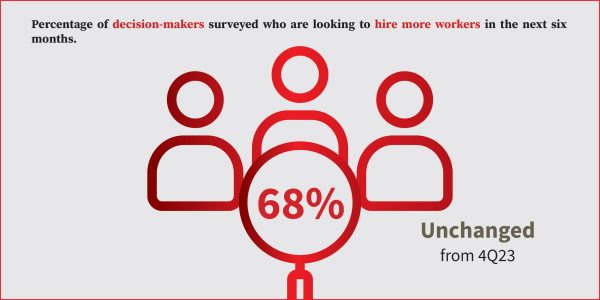

Regarding labor, 68% of decision-makers surveyed said over the next six months they’ll be looking to hire more workers. That percentage is unchanged from 4Q23, which could be an indicator of the challenges companies are having in finding talent.

“Despite these challenges, we view the current times as robust for economic development,” said an economic development executive. “Our efforts extend to connecting companies with both informal and formal networks to help them find the right talent, as our workforce is regional, drawing from Delaware, Pennsylvania, New Jersey, and Maryland. Despite the logistical challenges of securing supplies and equipment, the interest and enthusiasm for the Greater Philadelphia area and Delaware remain strong, underscoring a positive outlook for our region’s economic development.”

In some industries, however, hiring has slowed, with one Massachusetts-based architecture firm executive observing “quite a few layoffs in major corporations because the world is slowing down and belt-tightening measures,” leading to more people looking for opportunities in the workforce. “A couple of years ago everyone was hiring, but now as an employer we can be more selective in who we hire,” she added.

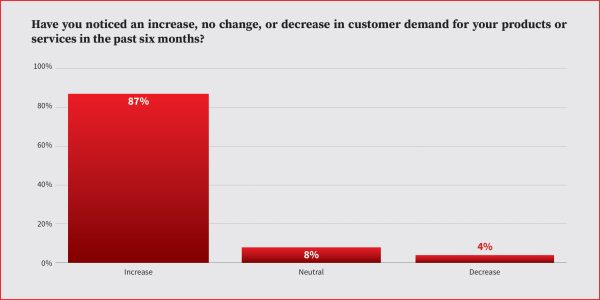

Business leaders also noted a continued demand for their products and services over the preceding six months, with 87% of those surveyed citing a slight increase — a 2% jump from the previous quarter and an 8% total jump since 3Q23.

Businesses, however, often need support to meet demand. It also requires proper planning and resource management. “Businesses must remain lean to thrive,” a Boston area executive told Capital Analytics. “We focus on understanding the successes across businesses of all sizes, sharing insights with those facing challenges in efficiency and resource management. It’s crucial for businesses to align their resources and investments for the best return. Sometimes, expanding rapidly or opening new locations without careful consideration can be detrimental. We share examples of both successes and missteps to guide companies in making informed decisions.”

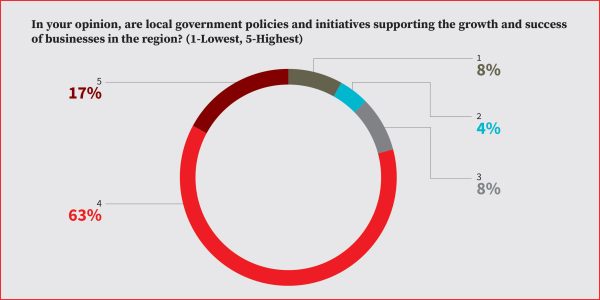

Opinions shared on government policies and initiatives supporting growth and business success are turning the corner and becoming more favorable in the Northern markets. Among the respondents, 80% expressed positive sentiment in terms of government support, up 42% from 4Q23. Those with a negative stance decreased from 19% in the fourth quarter to 12% in 4Q23, while 8% of the respondents remained neutral.

“Workforce issues remain a significant challenge for our industry, as they do for many others, but they are particularly pronounced in tourism. I’m exceptionally proud of Gov. (Josh) Shapiro’s recent proposals, presented in his budget last month, which aim to address these challenges head-on,” a CEO in the Pennsylvania tourism industry told Capital Analytics. “He has proposed a substantial increase in tourism funding, recognizing the industry’s composition of predominantly small and often minority-owned businesses. This increase is not just in tourism funding but extends to various small-business programs, enhancing resources to build out the ecosystem throughout Pennsylvania. The tourism industry is largely made up of small businesses, with worldwide statistics indicating that 80% of businesses in our sector are considered small. Gov. Shapiro’s proposals will help foster a more diverse workforce and support small businesses in our industry.”

For comprehensive business intelligence reports on 21 U.S. markets, click here to register.