Writer: Ryan Gandolfo

October 2025 — Business and economic sentiment changed little in the third quarter of 2025 as leaders pointed to market strength despite ongoing uncertainty, according to a new survey from caa.

October 2025 — Business and economic sentiment changed little in the third quarter of 2025 as leaders pointed to market strength despite ongoing uncertainty, according to a new survey from caa.

In September, the Federal Reserve cut interest rates for the first time in nearly a year, slightly moving the needle in a positive direction, but business leaders still see a murky overall picture.

“The cost of capital is just higher now,” a Tennessee-based commercial real estate investment firm managing partner told Invest:. “Investors are efficient and they’ll go where the best risk-adjusted return is. If you can’t offer that, they’ll put their money elsewhere.”

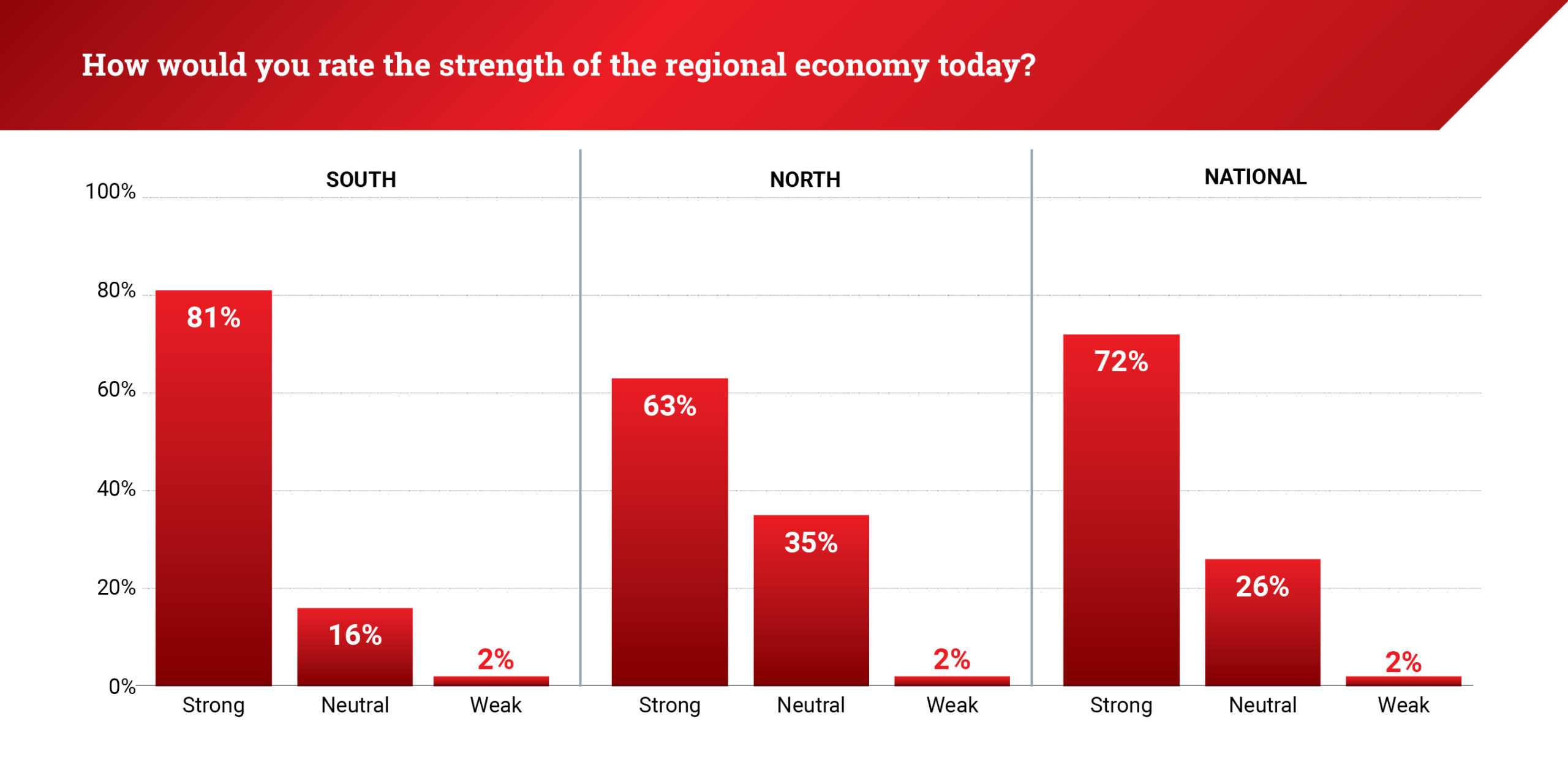

The survey of public- and private-sector leaders was conducted from July 1 through Sept. 30 and compiled in the Invest: Business Sentiment Survey (I:BSS). On average, respondents rated the strength of their regional economy at 3.95 out of 5, with 5 being the highest. The figure is virtually unchanged from the previous quarter.

Just under three-quarters (72%) of respondents viewed their regional economy as strong (4 or 5 out of 5). Southern market leaders were the most optimistic at 81%, while their Northern counterparts were less convinced, with only 63% rating their regional economy as strong.

The latest I:BSS findings come as the U.S. government endures an ongoing shutdown, halting key economic data releases on the job market, inflation, consumer spending, and business investment, Reuters reported. The 3Q I:BSS responses do not reflect the shutdown, which began on Oct. 1 and could impact sentiment in the final quarter of the year.

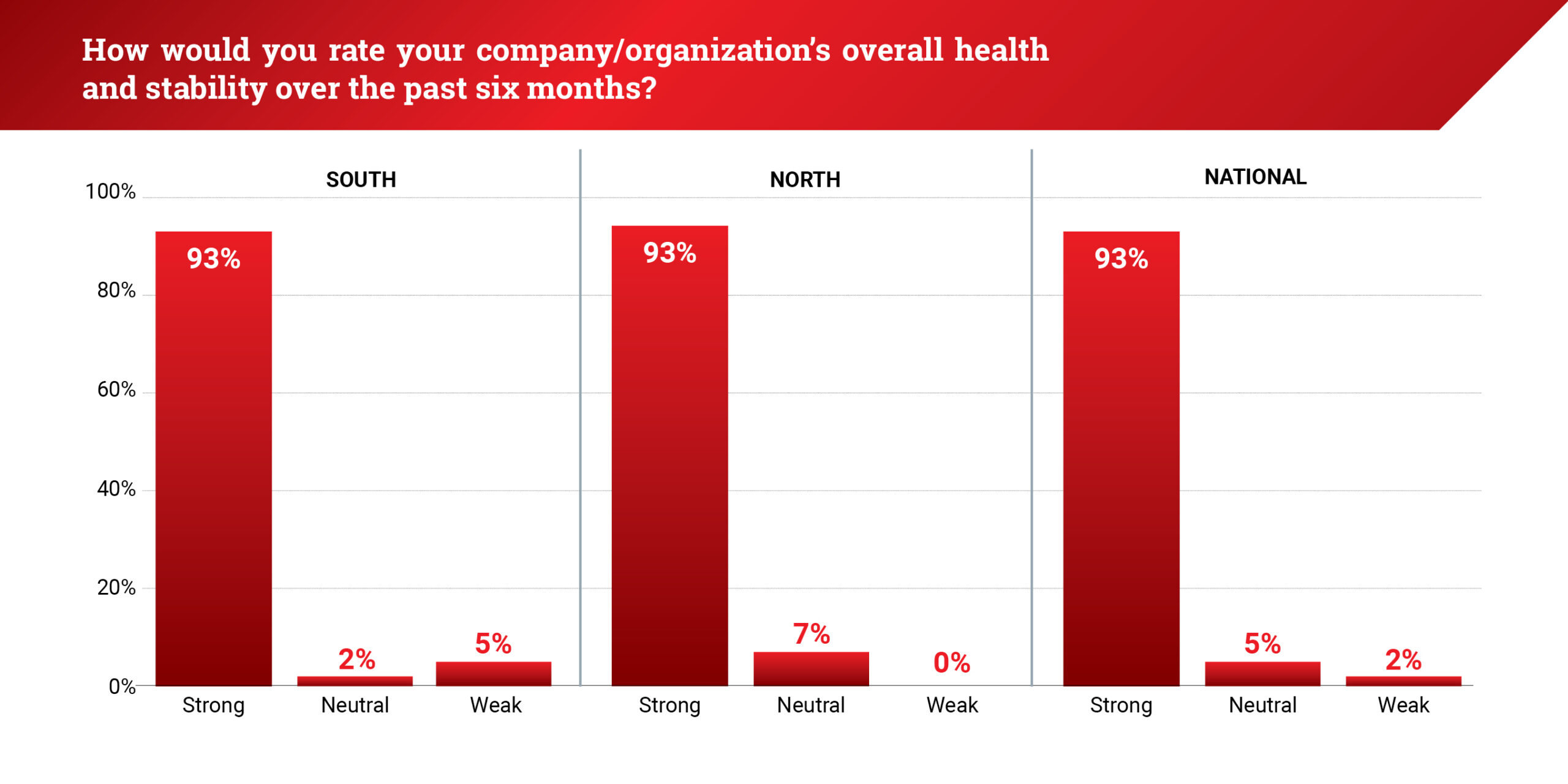

Regarding organizational health and stability, 93% of Northern and Southern market leaders held favorable views, rating their firm’s performance over the past six months at 4 or higher.

In the third quarter, leaders attributed sustained business activity to the strength of key markets.

“Markets in Dallas and the Atlanta area have maintained some activities that allowed us to keep moving forward,” an Atlanta-based construction firm CEO told Focus:. “Those are some of the most resilient markets across the country.”

Total U.S. construction spending reached a record $2.21 trillion in May 2024, on a seasonally adjusted annual basis, but has stagnated over the past 15 months following a 13-year upward trend. As of Oct. 7, the latest monthly report has yet to be released.

While confidence in company health and stability remained strong, labor market optimism has been more restrained throughout 2025. In 3Q25, 76% of survey respondents rated hiring expectations over the next six months at 4 or higher, compared to 79% in the third quarter of 2024.

Nationally, job openings remained unchanged at 7.2 million in August, according to the Bureau of Labor Statistics. However, Google Trends data shows searches for “hiring” falling to one of their lowest points in 2025 at the end of Q3.

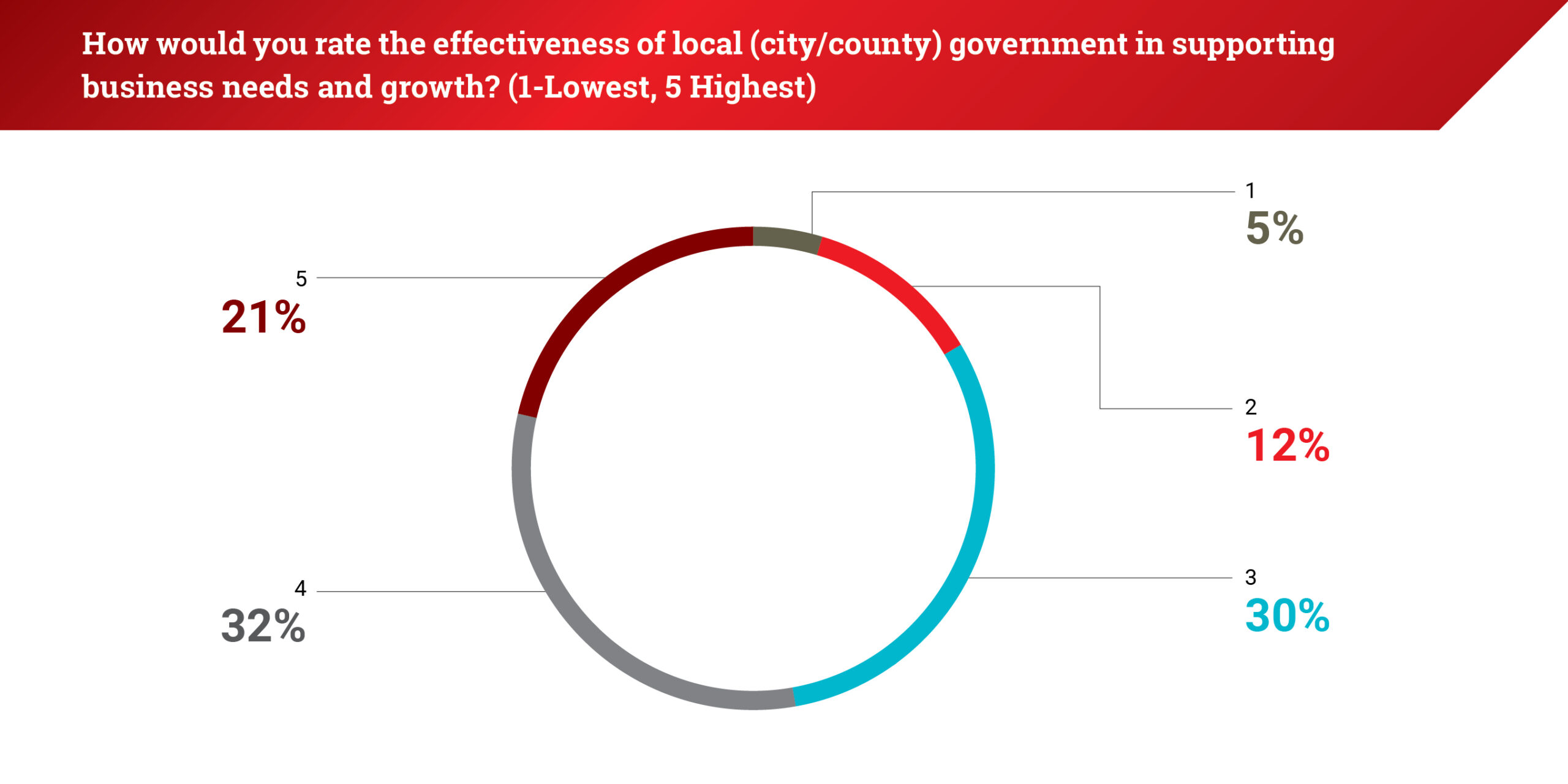

Just over half (53%) of respondents rated local government support for businesses as strong (4 or 5 out of 5), while 47% held neutral or negative views.

Continued growth across U.S. metro areas will depend on public and private sector collaboration, particularly in key areas like affordable housing.

“I don’t like mixing government with the private sector, but sometimes it’s necessary,” said a Tennessee-based entrepreneur to Invest:.

For more I:BSS reports, click here.

Subscribe to Our Newsletters

"*" indicates required fields