Writer: Ryan Gandolfo

January 2025 — Business leaders across the Northern and Southern United States are hopeful heading into 2025, according to the latest Capital Analytics Business Sentiment Survey (CABSS), conducted in the fourth quarter ended in December.

January 2025 — Business leaders across the Northern and Southern United States are hopeful heading into 2025, according to the latest Capital Analytics Business Sentiment Survey (CABSS), conducted in the fourth quarter ended in December.

“We’re very optimistic that our work for developer clients will get moving in the first quarter of 2025 as we expect interest rates will come down meaningfully in the near future,” said a Texas-based design firm leader. “Construction costs are starting to trend down as well.”

With responses from more than 130 public and private sector leaders in markets covered by Capital Analytics’ annual economic reports, from October 2024 through December 2024, market leaders ranked the strength of their regional economy 4.06 out of 5 (5 being the highest), on average. The new figure represents a slight decrease from the previous quarter.

Southern market leaders held more favorable views in the quarter, with 80% of respondents ranking their area economy 4 or 5, while 56% of Northern market leaders shared the same positive sentiment.

“Political uncertainty, cost recovery uncertainty and a splintered environment can make achieving growth objectives challenging. Fortunately, the Carolinas has a generally positive regulatory environment and our members are seasoned veterans in reaching out to stakeholders to accomplish objectives,” said a North Carolina-based energy leader.

In terms of organizational performance, both Northern and Southern market leaders held positive views at 84%, ranking their performance over the past six months at 4 or higher.

“Despite healthcare’s high costs, we consistently operate with a surplus, which is reinvested into programs and services that go beyond standard care,” said a Florida-based healthcare nonprofit executive.

Labor market enthusiasm dipped slightly as decision-makers showed lower interest in hiring compared to the previous quarter. In Southern markets, 77% of survey respondents rank hiring expectations over the next six months at 4 or higher, compared to 68% in Northern markets.

Nationally, the number of job openings has shown little movement: the U.S. Bureau of Labor Statistics reported 8.1 million job openings in November 2024 — a 3.8% increase compared to October 2024. Professional and business services, finance and insurance, and private educational services saw noticeable increases.

Meanwhile, demand for products and services in both Northern and Southern markets has remained strong, with 88%

and 87% of respondents ranking their demand at 4 or higher, respectively.

“The last three years have been similar in terms of growth, but the major change has been an influx of inventory. We added 2,000 new rooms this year alone. There are currently 51 properties in the pipeline, with an expected 1,490 additional rooms being added in the coming year. By 2026, we project 2,037 new rooms with 3,190 more by 2027. This surge is driven by investor confidence as well as the expansion of the Fort Lauderdale airport, which, due to international flights, has increased confidence in building more hotels,” said a South Florida-based hospitality industry executive.

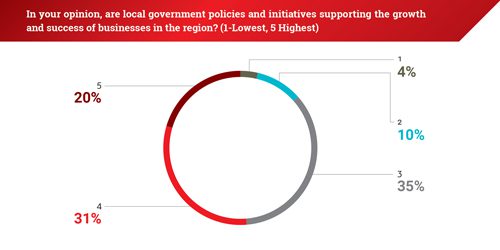

On local government support, market leaders wavered on optimism, with just over one-third (37%) of Northern leaders putting government support for business growth in the region at 4 or 5. In Southern markets, 55% gave a positive mark while 34% were neutral, and 12% had an unfavorable view.

Calls for more public-private partnerships were evident in responses gathered from business leaders in the construction industry.

“If government entities could recognize the efficiency gains, heightened quality, and overall collaborative construction environment that the private sector typically enjoys, the taxpayers and communities would benefit tremendously. But it requires trust in the partnerships, good benchmarking for cost validation, a shared fate outcome of the development/construction, and putting the mindset of ‘the low bid is always the right bid’ in the past,” a Carolinas-based construction executive vice president told Invest:.

For more CABSS reports, click here.