Writer: Andrea Teran

January 2026 — Business confidence across major U.S. metro areas remained resilient in the fourth quarter of 2025, according to the latest Invest: Business Sentiment Survey (I:BSS), even as executives adjusted expectations around hiring, borrowing costs, and global trade conditions.

January 2026 — Business confidence across major U.S. metro areas remained resilient in the fourth quarter of 2025, according to the latest Invest: Business Sentiment Survey (I:BSS), even as executives adjusted expectations around hiring, borrowing costs, and global trade conditions.

Join us at caa’s upcoming leadership summits! These premier events bring together hundreds of public and private sector leaders to discuss the challenges and opportunities for businesses and investors. Find the next summit in a city near you!

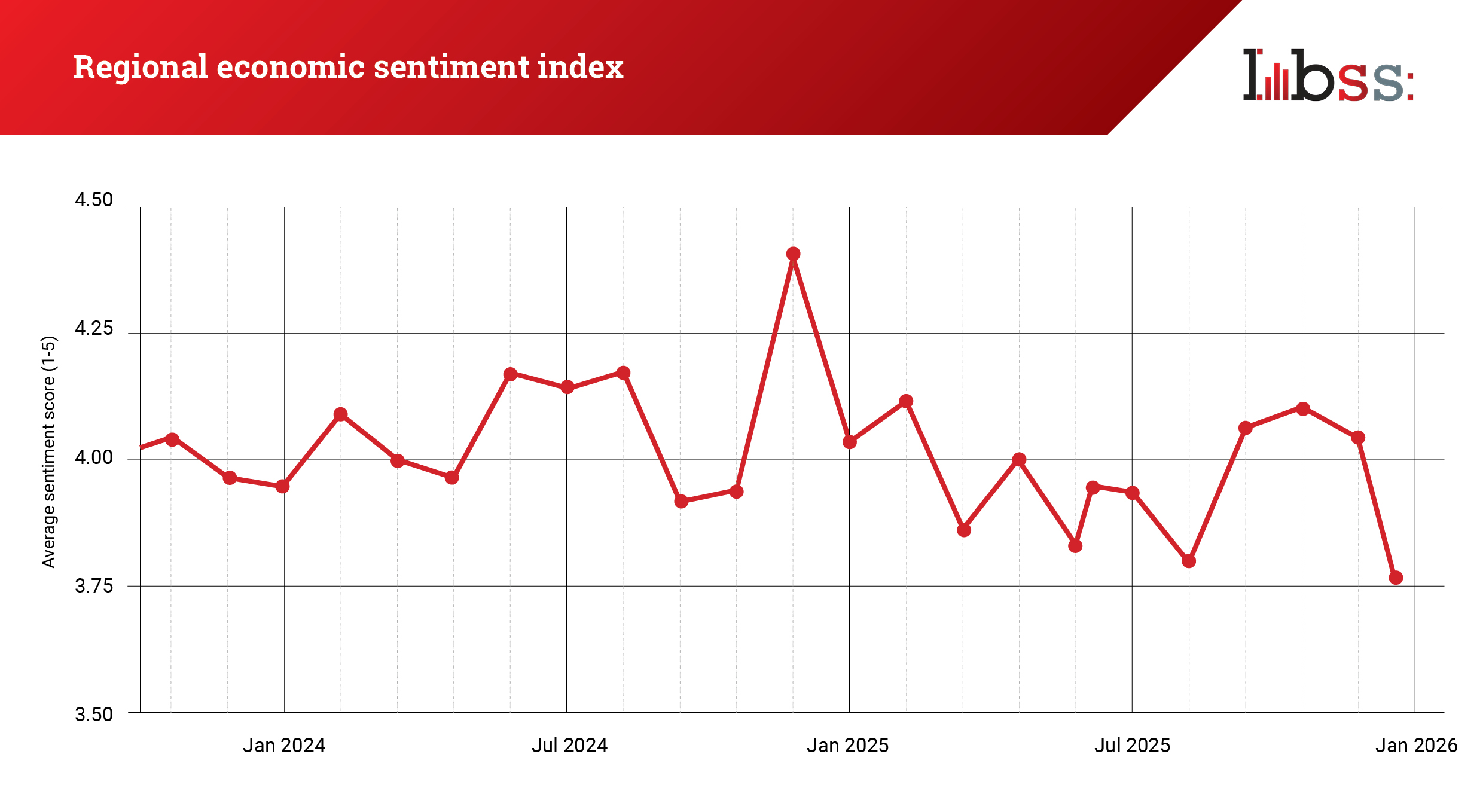

Survey responses showed stable regional economic sentiment and strong company performance amid signs of moderation in labor demand and continued pressure on financing conditions. The national average score for regional economic sentiment registered 3.98 out of 5, down slightly from 4.06 in 4Q24.

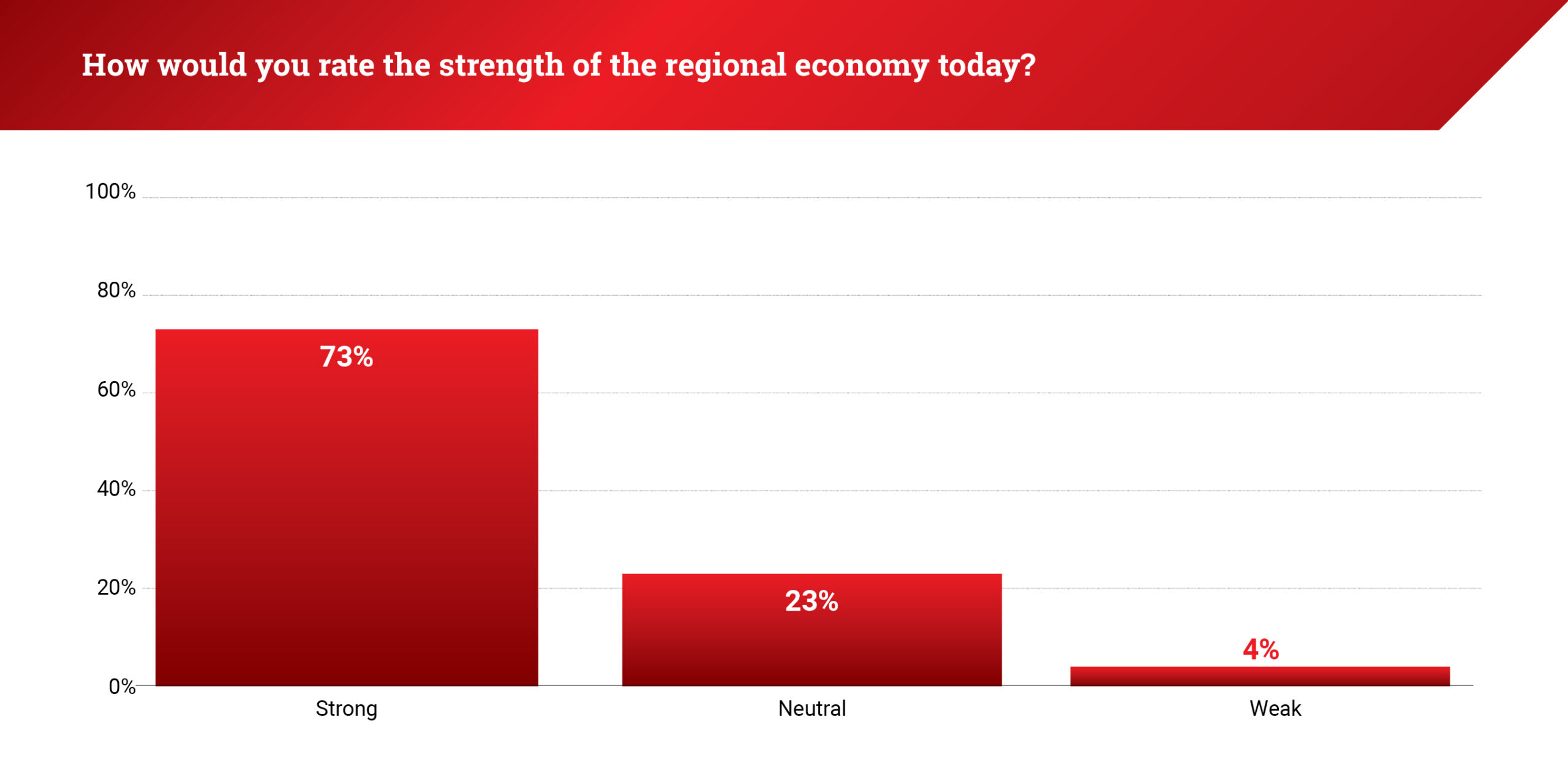

About 73% of leaders rated their regional economy as strong — down from 76% one year earlier.

About 73% of leaders rated their regional economy as strong — down from 76% one year earlier.

“The biggest challenge by far is the cost of capital. Interest rates have stayed high longer than many expected, and that’s dampened traditional real estate development,” a managing partner in the legal sector told caa.

“The biggest challenge by far is the cost of capital. Interest rates have stayed high longer than many expected, and that’s dampened traditional real estate development,” a managing partner in the legal sector told caa.

These survey results align with broader macroeconomic forecasts showing a slowdown in U.S. growth. According to the Federal Reserve Bank of Philadelphia’s Q4 2025 Survey of Professional Forecasters, real GDP growth is estimated at 1.9% for 2025, and 1.8% in 2026, down from 2.3% in 2024, with weaker momentum expected heading into 2026.

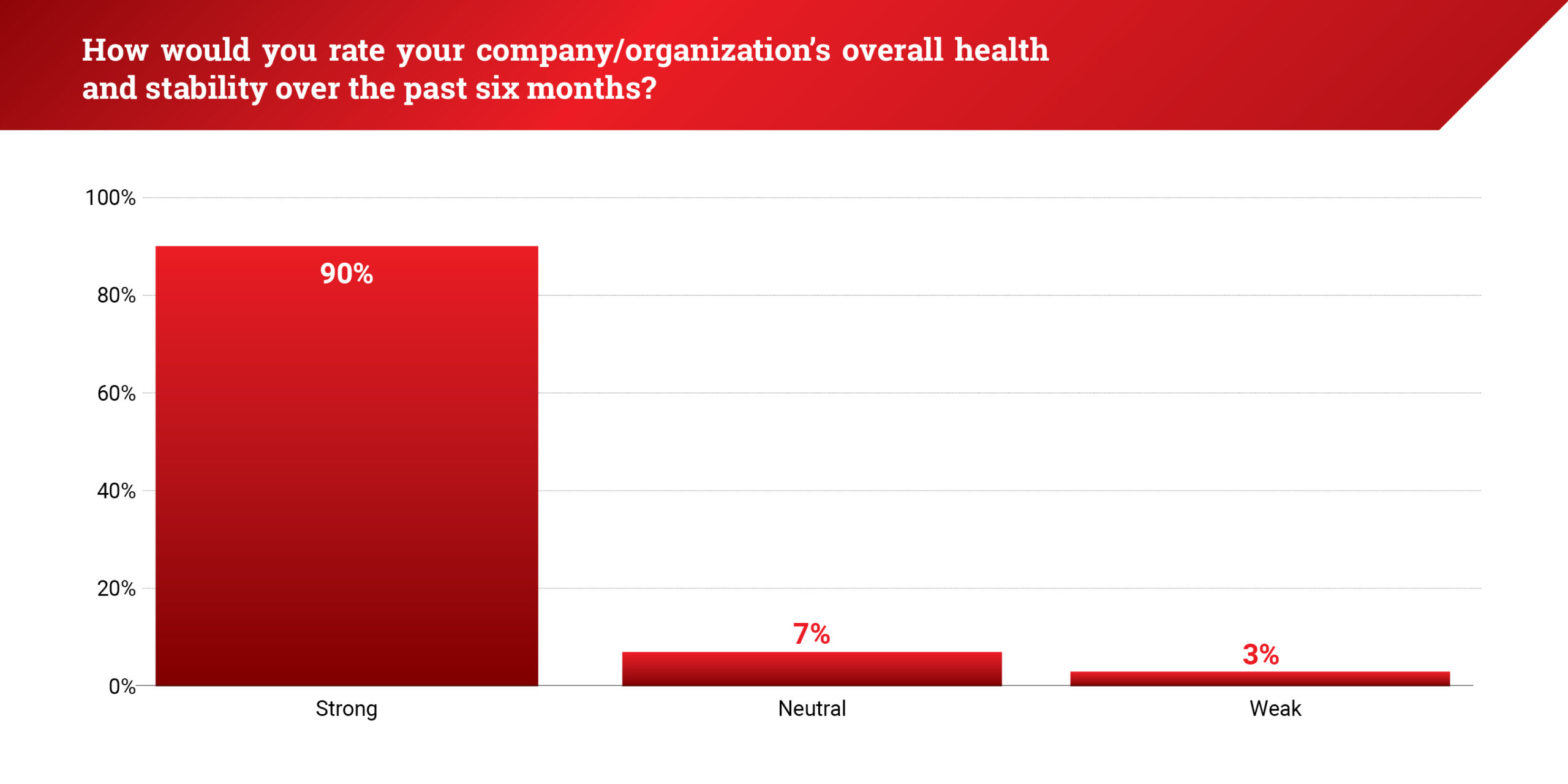

Despite the headwinds, nine in 10 respondents rated their company’s performance over the past six months as strong, up from 84% in 4Q24, though slightly below 93% in 3Q25.

“We’re investing in our people through education and development… Managers are instructed to look for and share training opportunities with their team members,” a banking president and CEO shared with caa.

“We’re investing in our people through education and development… Managers are instructed to look for and share training opportunities with their team members,” a banking president and CEO shared with caa.

This improvement in company performance sentiment came even as hiring and production indicators softened. Manufacturing activity, in particular, showed contraction in late 2025, reflecting persistent cost pressures and weaker new orders.

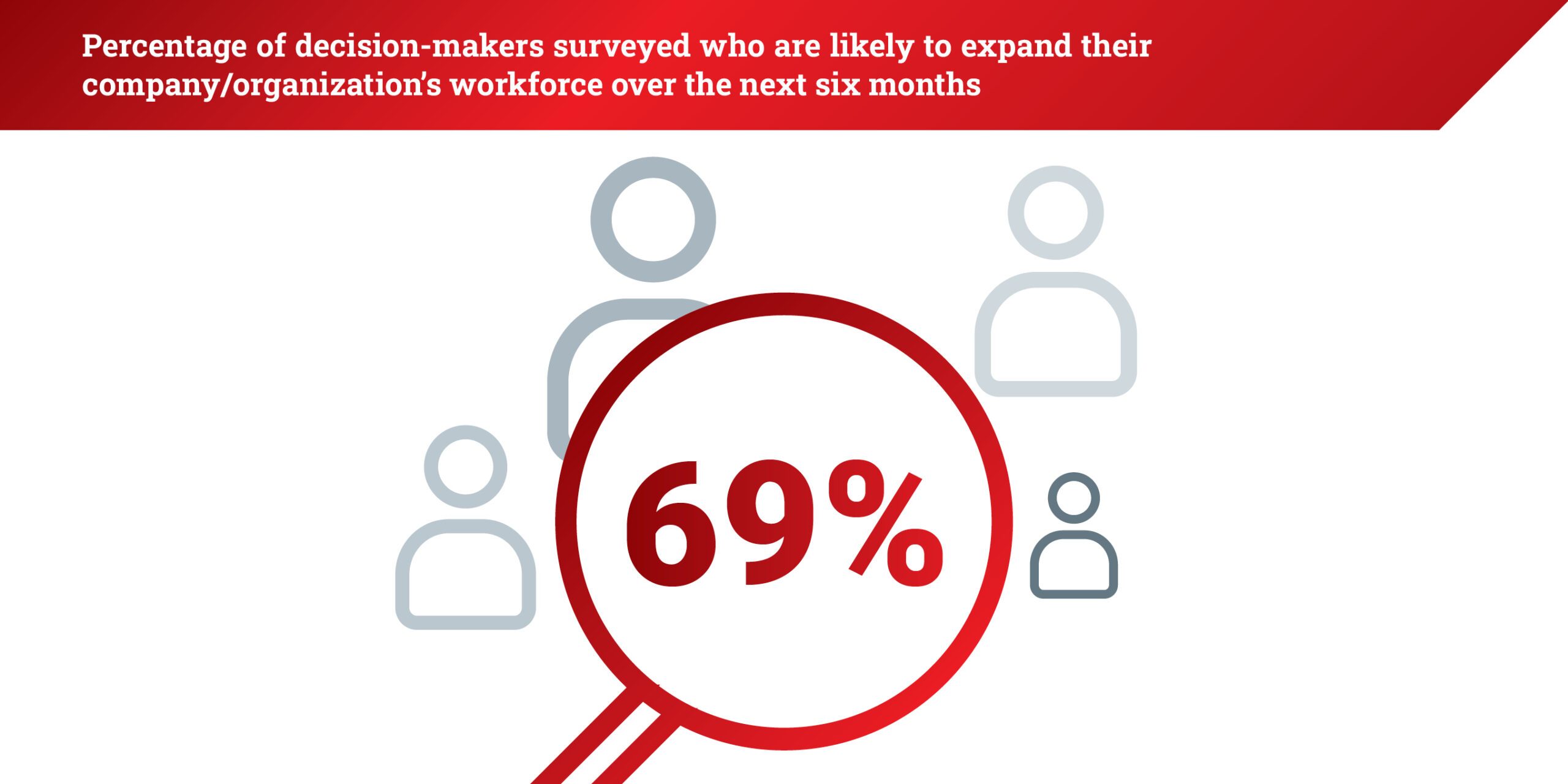

Hiring expectations for the next six months softened compared to previous quarters. Sixty-nine percent of respondents said they expect to expand their teams, down from 75% in 3Q25 and 73% a year earlier.

“Hiring is challenging across all industries right now, given slow population growth and demographic shifts… It’s about being proactive, responsive, and continually investing in our people.” A financial institution executive in the Northeast shared with caa.

“Hiring is challenging across all industries right now, given slow population growth and demographic shifts… It’s about being proactive, responsive, and continually investing in our people.” A financial institution executive in the Northeast shared with caa.

Labor market indicators point out this cooling trend. The national unemployment rate rose to 4.6% in November 2025, its highest level since 2021, as job growth slowed and hiring caution increased.

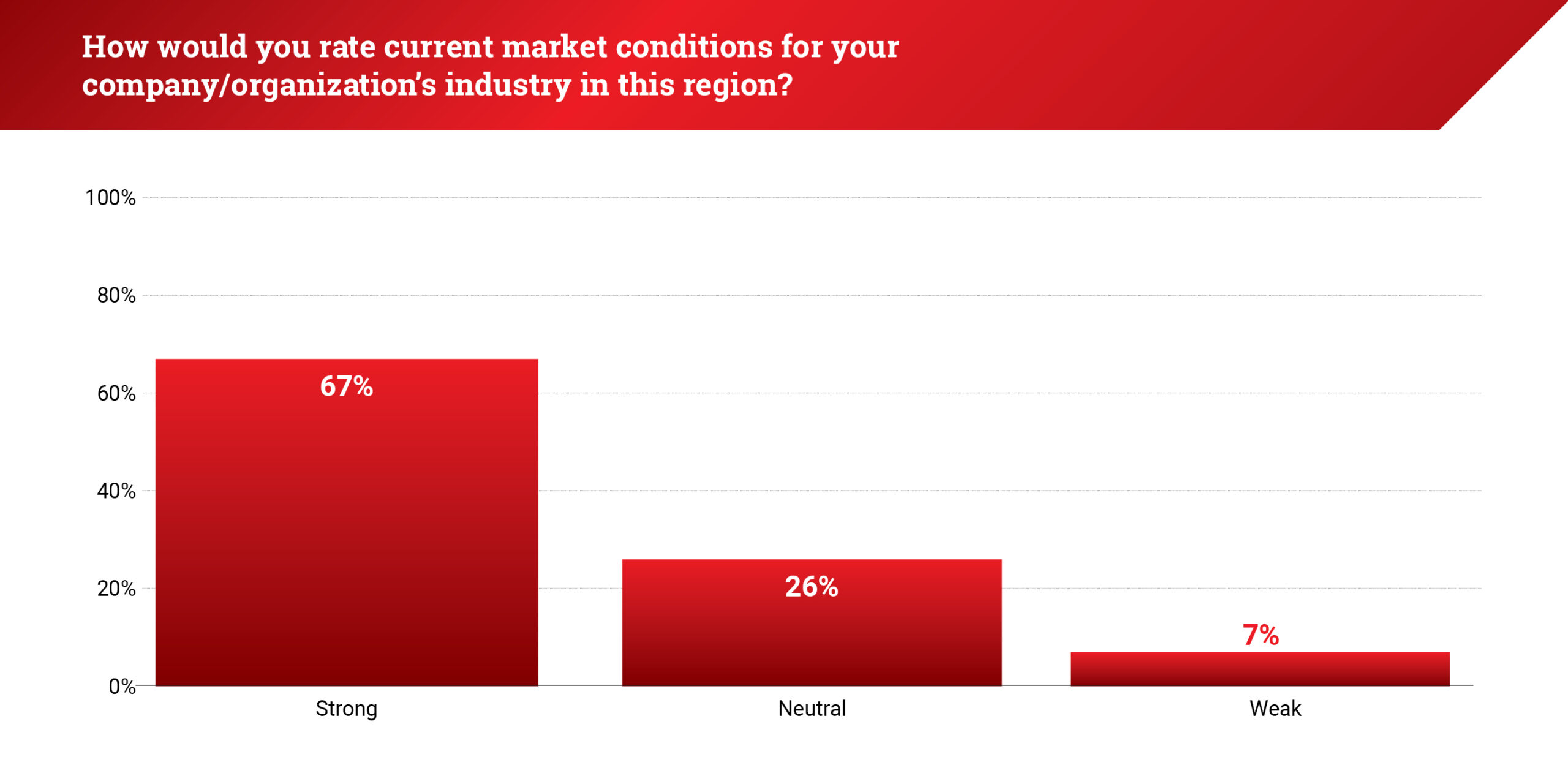

When asked about current market conditions in their sector, 67% of leaders rated them as strong, 26% as neutral, and 7% as weak. The share of respondents rating conditions as weak increased from 4% in 3Q25.

“Everyone is still bullish on where we’re going… The question is when the floodgates will open. We just need stability,” a managing partner in accounting and real estate advisory told caa.

“Everyone is still bullish on where we’re going… The question is when the floodgates will open. We just need stability,” a managing partner in accounting and real estate advisory told caa.

Persistent trade policy uncertainty and the lagged effects of higher tariff rates are contributing to reduced investment appetite and weaker trade flows. According to the OECD’s December 2025 Economic Outlook, global GDP growth is projected to slow from 3.2% in 2025 to 2.9% in 2026, as the impact of trade barriers and policy unpredictability weighs on cross-border activity. While financial conditions are expected to improve later in the year, near-term business confidence remains tempered by lingering geopolitical risk and elevated input costs.

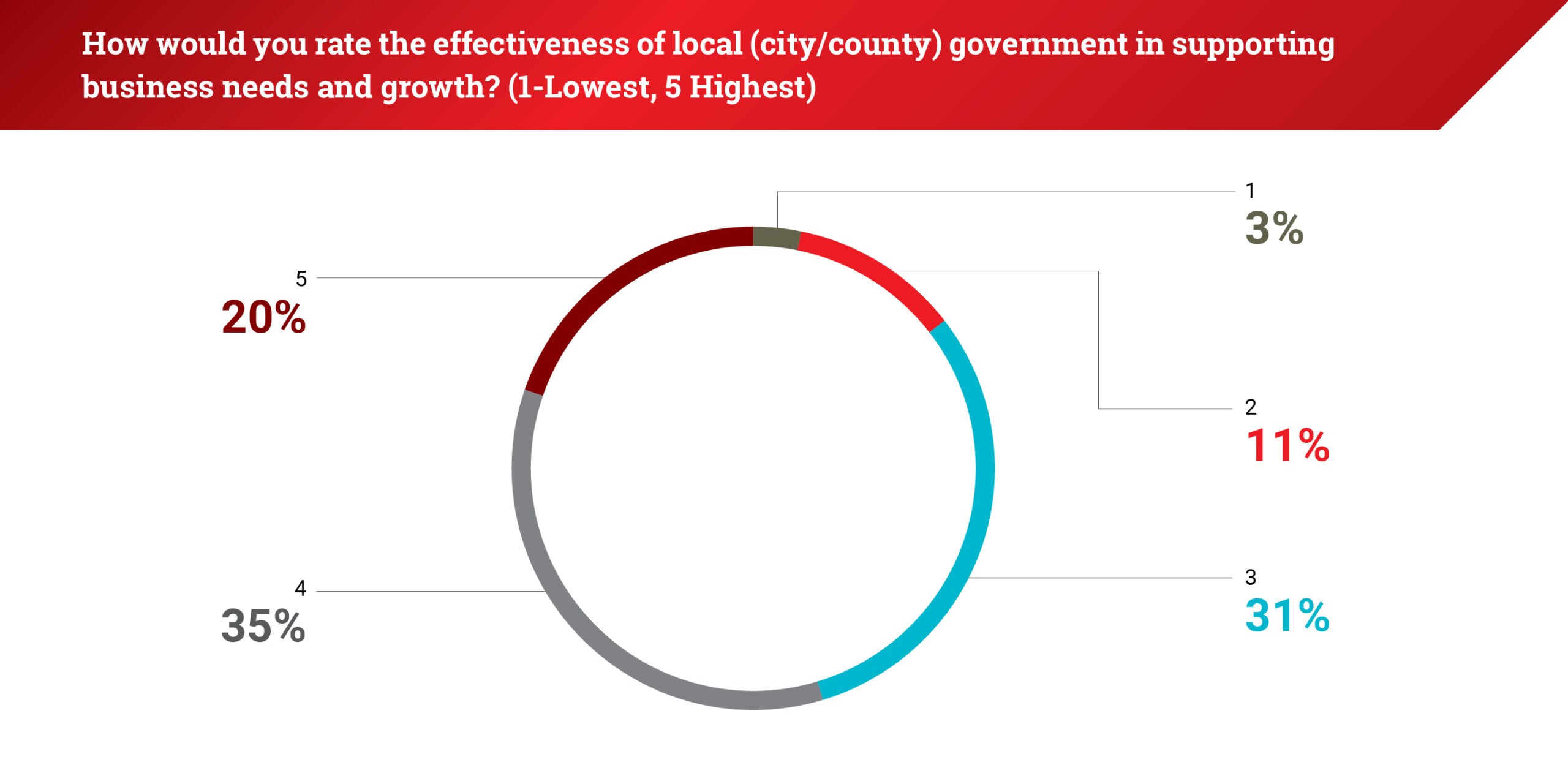

Local government support showed modest improvement. Fifty-five percent of respondents rated local government support as strong, up two points from the third quarter.

“Charlotte’s public-private partnerships are key. The transportation bill and the city’s collaborative approach stand out among U.S. metros,” A real estate-focused shareholder in professional services said to caa.

“Charlotte’s public-private partnerships are key. The transportation bill and the city’s collaborative approach stand out among U.S. metros,” A real estate-focused shareholder in professional services said to caa.

The Federal Reserve cut its benchmark interest rate three times in 2025, bringing the target range to 3.50%–3.75% in an effort to support employment and ease financial conditions. Officials have indicated that further rate adjustments will depend on incoming economic data and inflation trends, leaving monetary policy a key variable for business planning in 2026.

For more I:BSS reports, click here.