Writer: Ryan Gandolfo

3 min read July 2023 — The inaugural Capital Analytics Business Sentiment Survey (CABSS) of 200 public and private sector leaders based in Southern markets revealed a level of resilience in the second quarter and cautious optimism for the remainder of 2023.

3 min read July 2023 — The inaugural Capital Analytics Business Sentiment Survey (CABSS) of 200 public and private sector leaders based in Southern markets revealed a level of resilience in the second quarter and cautious optimism for the remainder of 2023.

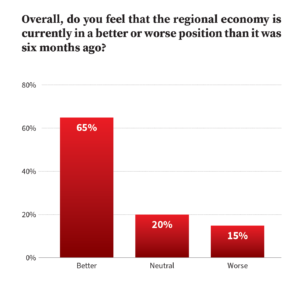

Covering major industries from professional services and finance to real estate, education, healthcare and others, the Q2 CABSS showed 65% of respondents felt the regional economy was in a better position than it was six months ago, compared to 15% who said it was worse off.

“There’s been layoffs in the technology space over the last three to six months which are usually the kind of leading indicator in our industry that things may get back to a slightly more normalized environment of talent,” said a Texas-based professional services executive. “In the last two years, the demand for talent in our profession has far exceeded the supply more than any time in my entire career. I think the next year or so is going to be a little easier, but it’s still going to be a challenge.”

Respondents highlighted businesses’ ability to make adjustments to account for rising costs or supply chain disruptions in addition to pent-up demand. In construction, for example, this has meant swapping materials to maintain project timelines and constant communication with vendors. Demand in Q2, however, remained relatively strong across Southern markets given the influx of residents. “People will always drive the need for construction. Infrastructure, schools, grocery stores, police and fire stations, you name it,” said a North Carolina-based construction firm president.

Respondents highlighted businesses’ ability to make adjustments to account for rising costs or supply chain disruptions in addition to pent-up demand. In construction, for example, this has meant swapping materials to maintain project timelines and constant communication with vendors. Demand in Q2, however, remained relatively strong across Southern markets given the influx of residents. “People will always drive the need for construction. Infrastructure, schools, grocery stores, police and fire stations, you name it,” said a North Carolina-based construction firm president.

A Texas-based chamber president also noted that sustained consumer demand in the automotive industry demonstrated confidence despite higher interest rates. (U.S. new vehicle sales rose in Q2, with 1.37 million units sold in June.)

However, others have struggled to overcome those higher costs and delays on essential equipment. A Florida-based mayor said his city has had to account for a 20% increase in costs, impacting citywide operations and future planning.

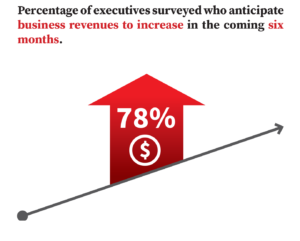

Positive sentiment was generally reflected in respondents’ anticipated business revenue in the coming six months, with more than two-thirds (78%) expecting to grow their revenue during the remainder of 2023 while 22% anticipate revenues remaining the same or decreasing.

In the hospitality sector, leaders said hiring challenges — a key theme for the industry in the year since the coronavirus pandemic — have been overcome to an extent, with businesses finding it somewhat easier to meet increased demand post-pandemic. “Going into the year, we were both optimistic and aggressive in setting our revenue projections and were delighted to close the year out exceeding our expectations,” said an Atlanta-based hotelier.

Following historic bank runs and rising interest rates in the first quarter of 2023, the second quarter was relatively stable, with the Federal Reserve pausing interest rate increases in June as U.S. inflation continues a descent toward normalcy, partly accounting for the overall cautiously optimistic tone of the survey.

But there remain warranted concerns due to higher interest rates that have led business owners and executives to expect more volatility in 2023, particularly if publicly traded company earnings don’t meet market expectations. “2024 could probably be the start of a new bull market. We’re confident we just have to go through the eye of the storm right now,” said a Miami-based wealth management executive.

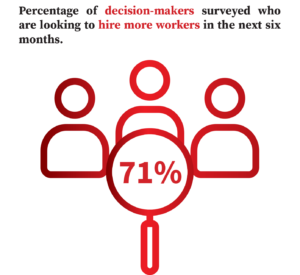

Among those surveyed, labor was a central theme, with partnerships created between the business community and educational institutions to overcome a challenging labor market. Seven out of 10 respondents are looking to hire more workers in 2023, particularly in healthcare, hospitality, construction as well as the public sector.

According to Google Trends, a keyword search for “hiring” was at peak popularity in June 2023. With the growth experienced in U.S. Southern markets from a business and population standpoint, “workforce and workforce development remain a challenge,” according to a Charlotte-based construction company president. Markets such as South Florida, which have seen costs of living soar in recent years, are also having difficulty retaining current employees due to high median home prices in addition to a property insurance crisis as insurers have gone insolvent or pull out of the Sunshine State. “Labor concerns are merely the tip of the iceberg,” said a South Florida-based university president.

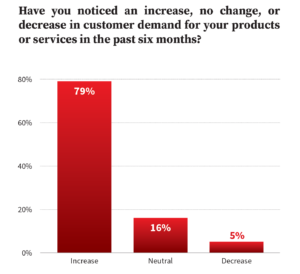

A greater need for labor is compounded by an increased demand for products and services, which nearly 4 out of 5 of those surveyed experienced in the past six months. Sixteen percent of respondents said there was no change while 5% saw a decrease in demand. With a confluence of factors in higher interest rates and elevated costs impacting demand, Southern markets have shown resilience due to overall growth. As a Florida-based bank president noted, “While construction costs and land costs have remained relatively elevated for some time now, when you add in higher borrowing costs, projects that penciled out 12-18 months ago no longer work. … Despite that situation, we are seeing a decent demand coming from folks who are entering the market as they move to Florida from other states.”

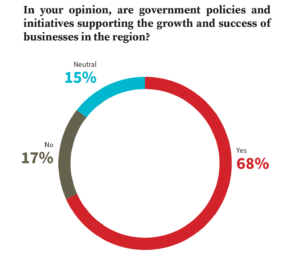

Over the past three years, businesses and families in the United States have picked up and moved to greener pastures at a significant rate, with Southern states the clear winners. Commonly cited reasons for relocation have been business-friendly environments and tax incentives. In the Q2 CABSS, 68% of respondents believe government policies and initiatives have supported the growth and success of businesses in the region, while 32% feel more could be done or had a neutral perspective.

Those expecting more from government policies and initiatives brought up local competitiveness as a hindrance to boosting the growth of the region, in addition to creating a more inclusive environment for businesses of all backgrounds and sizes to thrive. “We have many opportunities in the area of access to capital, which is always the No. 1 issue,” said a Texas-based chamber president.

Moving forward, businesses and organizations will continue monitoring economic conditions in their respective areas. While internal and external challenges persist, leaders are adapting to a new level of preparedness that should help them navigate what lies ahead.

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.