Writer: Ryan Gandolfo

3 min read January 2024 — Private and public sector leaders in the U.S. Northern markets covered by Capital Analytics’ annual business reviews expressed a downward shift in economic sentiment in 4Q23. The last quarter of the year saw interest rates stabilize and inflation fall to nearly 3%, but a level of economic uncertainty carried into 2024 due to geopolitical conflicts.

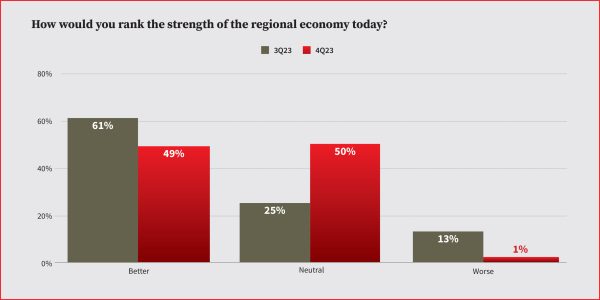

In the latest survey of more than 70 public and private sector leaders, the Capital Analytics Business Sentiment Survey (CABSS) for 4Q23 found overall business sentiment lower from the previous quarter. Compared to 3Q23, there was a 12% decrease in survey respondents viewing their regional economy in a positive light, dropping from 61% to 49%. The majority of respondents (50%) viewed their regional economy in a neutral light.

Over the October to December period, those surveyed shared their sentiment from a rating scale of 1 to 5 (5 being the highest). The average score among total respondents was 3.56 out of 5.

The changes in the market impacted businesses across all sectors, whether it be inflation, interest rates or labor challenges. The impact of the hybrid environment on the workplace was top of mind for many business leaders.

“The only major change that has impacted our business relates to post-COVID hybrid work. We have taken a thoughtful, data and evidence-based approach to hybrid work to ensure everyone here feels supported while also being part of something bigger than them,” a mid-Atlantic market law firm partner told Capital Analytics.

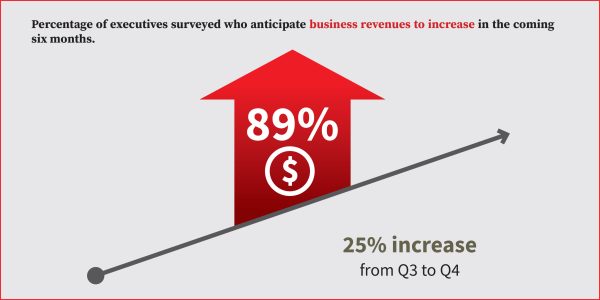

Despite the souring of economic sentiment, leaders remained positive on future revenue growth. Eighty-nine percent of those surveyed expect business revenues to increase in the coming six months — a 25% increase from 3Q23.

“In the third quarter of 2023, Philadelphia saw a huge increase in venture capital and we are seeing the formation of many new companies. We’re seeing a proliferation of lab space that is attracting companies from around the world,” said a life sciences industry executive to Capital Analytics.

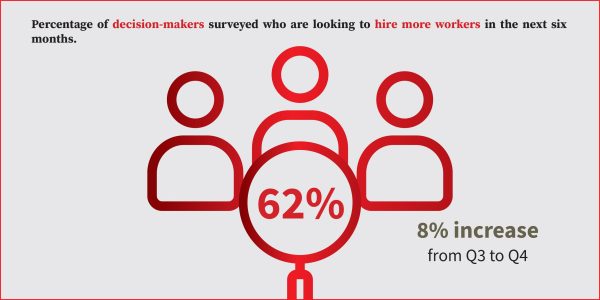

Regarding labor, 62% of decision-makers surveyed said over the next six months they’ll be looking to hire more workers, an 8% increase from the third quarter, but finding those employees remains a challenge.

“It’s increasingly challenging to find labor, particularly in construction, as the market is booming. While other sectors might be different, the demand for skilled workers in renewables is undeniable. We’ve been fortunate to have established relationships with contractors we’ve collaborated with over the past four years in the United States. This continuity allows us to buffer against some of the labor challenges. However, as an industry, the labor constraint is becoming a more pressing issue,” said a Northeastern market leader in the renewable energy space.

In some industries, however, hiring has slowed, with one Pennsylvania-based recruitment firm CEO observing a “noticeable pause in hiring by companies” leading to a temporary hold on recruitment. “It appears to be an intersection of factors, including concerns about the economy and the anticipation of potential challenges. Additionally, the impact of artificial intelligence on careers has started to emerge, although specific data may not yet reflect this shift accurately,” he added.

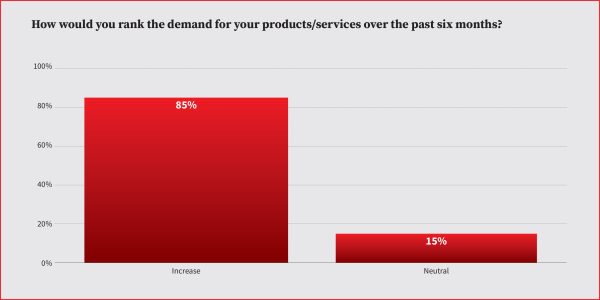

Business leaders also noted a continued increase in demand for their products and services over the preceding six months, with 85% of those surveyed citing an increase — a 6% jump from the previous quarter and 11% total jump since 2Q23.

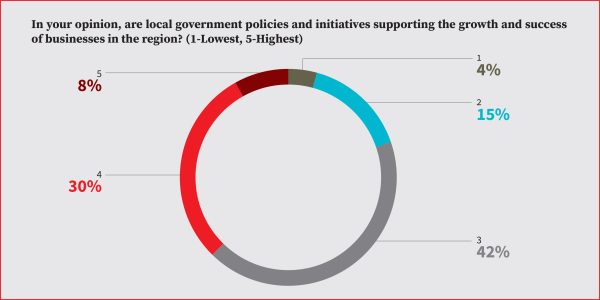

Similar to 3Q23, opinions shared on government policies and initiatives supporting growth and business success remained lower than the CABSS for Southern markets. Among the respondents, 38% expressed positive sentiment in terms of government support while 42% remained neutral. Those with a negative stance decreased from 22% in the third quarter to 19% in 4Q23.

A director in Massachusetts’ tourism industry, for example, noted they would like to “see more small business support from the public sector through funding for tourism marketing,” adding that the impact is measurable and industry sector distribution is direct.

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.