Writer: Ryan Gandolfo

3 min read October 2023 — The past quarter showed a continuation of major trends as business leaders expressed a relatively tepid tone over economic conditions impacting their companies and organizations, emphasizing the lack of activity in capital markets and pointing toward a general economic slowdown.

3 min read October 2023 — The past quarter showed a continuation of major trends as business leaders expressed a relatively tepid tone over economic conditions impacting their companies and organizations, emphasizing the lack of activity in capital markets and pointing toward a general economic slowdown.

Inflation has held steady through September and the expectations that the Federal Reserve will raise interest rates again have lowered, signaling a possible shift away from the uncertainty in the market throughout 2023.

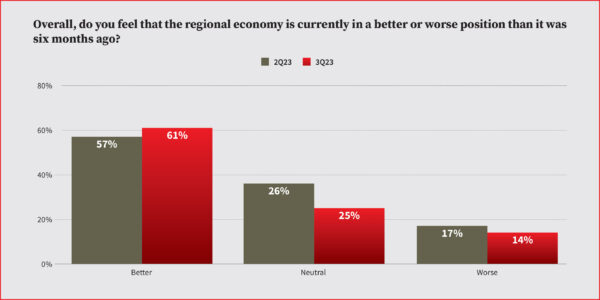

In speaking with dozens of public and private sector leaders in the Northern markets covered by Capital Analytics’ annual business reviews, in the latest July to September quarter, the Capital Analytics Business Sentiment Survey (CABSS) found overall sentiment only slightly higher than the previous quarter. Compared to 2Q23, there was a 4% increase in positive regional economy sentiment, from 57% to 61%. One-quarter of leaders responding to the survey expressed a neutral viewpoint — mostly unchanged from the second quarter. Changes in the capital markets are among the factors impacting sentiment.

“We are seeing some slowdown on the transactional side and that’s because the capital markets are not there. And if the capital markets aren’t there, then the private equity gets impacted and the venture capital gets impacted. But what we see is that in these times, people and companies are more innovative,” said a managing partner at a law firm with offices in Minneapolis, Philadelphia and other U.S. cities. In September, a Crunchbase report noted this year was on pace to be the slowest for venture capital funding since 2017, with just over 200 deals of $100 million or more raised by U.S.-based companies.

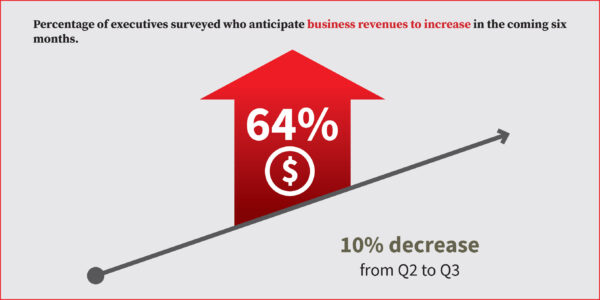

Anticipated business revenues took a hit last quarter, with 64% of those surveyed expecting business revenues to increase in the coming six months — a 10% decrease from 2Q23. “Capital markets and investment sales have slowed down, leading to a quieter environment. Many are uncertain about the future, which has resulted in shorter-term leases and decreased leasing velocity. Financing has become increasingly challenging, with fewer banks providing quotes for deals. Despite these challenges, deals are still being completed,” said a Massachusetts-based commercial real estate agency CEO.

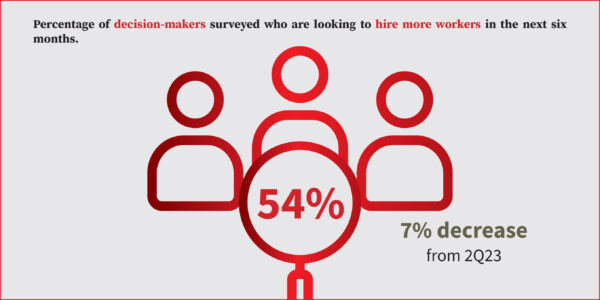

On the labor side, 54% of decision-makers surveyed said over the next six months they’ll be looking to hire more workers, a 7% decrease from the second quarter. “We must contend with the multifaceted demands of sustaining our faculty, advancing research and upholding the quality of our facilities, including residence halls, labs and classrooms,” a university president in central Massachusetts told Capital Analytics.

Colleges have been exploring ways to save on labor through outsourcing, as a study led by Hill Group found five Pittsburgh area schools could save more than $20 million collectively by using a shared-services model for back-office functions.

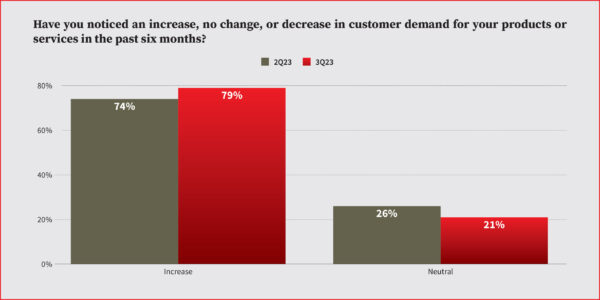

Business leaders also noted an increase in demand for their products and services over the past six months, with 79% of those surveyed noticing an increase — a 5% jump from the previous quarter. This was also 3% higher than the survey results in Capital Analytics’ Southern markets.

“We are part of a health system that is an economic engine that is a leader in multiple areas of healthcare delivery, including the acute, post-acute and ambulatory spaces, as well as research, innovation and medical education,” said a New England-based hospital president, adding that their outlook remains positive heading into 2024.

READ MORE: Q3 Southern business sentiment strikes uncertain but upbeat chord

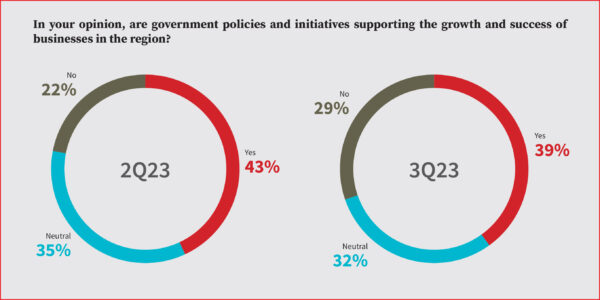

Similar to 2Q23, opinions shared on government policies and initiatives supporting growth and business success remained lower than the Southern markets survey. Among the respondents, 39% expressed positive sentiment in terms of government support while 32% remained neutral. Those with a negative stance increased from 22% in the second quarter to 29% in 3Q23.

Compared to the Southern CABSS report, positive sentiment on government policies and support is nearly 20% lower in the North — contributable to a slower economic recovery from the pandemic in some downtown areas and higher tax base on average.

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.