Writer: Ryan Gandolfo

3 min read January 2024 — Public and private sector leaders in the U.S. Southern markets covered by Capital Analytics’ annual business reviews expressed opportunities to overcome economic headwinds amid a nationwide downturn in labor demand, easing inflation, and stabilized interest rates to cap off the final quarter of 2023.

3 min read January 2024 — Public and private sector leaders in the U.S. Southern markets covered by Capital Analytics’ annual business reviews expressed opportunities to overcome economic headwinds amid a nationwide downturn in labor demand, easing inflation, and stabilized interest rates to cap off the final quarter of 2023.

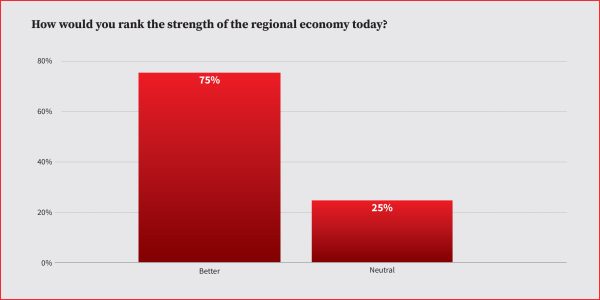

The Capital Analytics Business Sentiment Survey (CABSS) for 4Q23 found overall business sentiment higher from the previous quarter. Compared to 3Q23, the latest survey of nearly 150 public and private sector leaders showed a noticeable uptick in regional economy sentiment, from 69% to 75% who viewed their area’s economy in a positive light.

Over the October to December period, survey respondents graded the strength of their regional economy on a scale from 1 to 5 (5 being the highest) — with an average score of 3.97 among participants.

“We initially anticipated that inflation and the rising construction costs would have a significant impact on our workload and that some clients would pull back the reins on their projects. Nevertheless, we have not seen that happen, due in large part to our diversified portfolio and volume of public work,” a Texas CEO of an engineering firm told Capital Analytics. “The funding cycles of public projects are planned well in advance, so we see the impacts later,” he added.

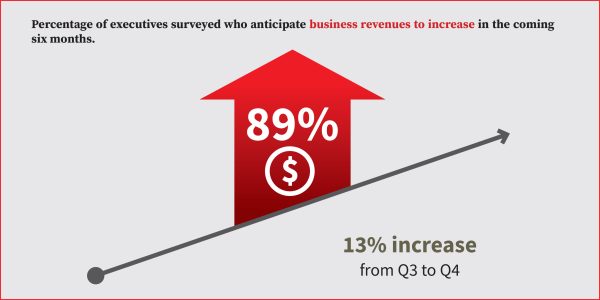

From a revenue standpoint, 89% of businesses are anticipating growing their earnings in the coming six months in the U.S. Southern markets, according to our 4Q23 survey. With an average score of 4.16 out of five, just 11% of those surveyed anticipated steady or declining revenue.

“More transaction work is popping up, which is promising as it indicates increased activity in the market. It’s good to see things picking up on that front as people seem to be growing more comfortable with what the (Federal Reserve) is doing. Yet, the market remains challenging due to the rising costs,” said a San Antonio-based Big Four managing director.

The Fed has boosted interest rates 11 times over the last year and half to above 5% as it fights inflation. In its latest meeting in December, however, central bank policymakers indicated that they would cut rates three times in 2024. According to Reuters, a majority of economists polled by the media outlet anticipate the first rate cut happening in June and fewer cuts forecasted in 2024 than previously expected.

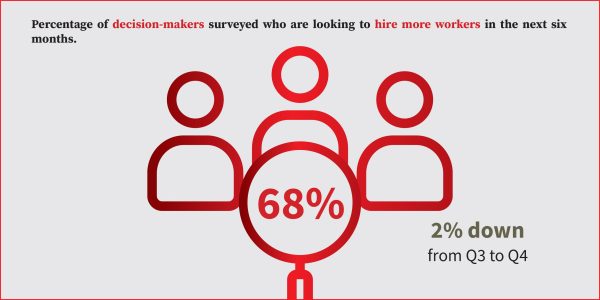

From a labor market perspective, the percentage of decision-makers looking to hire more workers in the coming six months dipped to 68%, a 2% decrease from the previous quarter. Labor costs have been among the key challenges for many sectors across the economy.

“We are concerned about cost increases, particularly personnel costs. During COVID-19, hospitals had to pay quite a bit of money to nurses and many people got used to a certain pay rate, so they are demanding that in the market. This has complicated recruiting processes as we need to be able to compete with hospital salaries. I am not sure that that is sustainable for a $60 billion health system. These costs would be less of a concern if managed care organizations would give the same amount of increase that we have experienced from inflation, but that has not been the case,” said a Tennessee-based healthcare leader. She noted that “technology will cause a need for fewer workers in healthcare,” allowing companies to improve efficiencies by deploying personnel to areas where they are most needed.

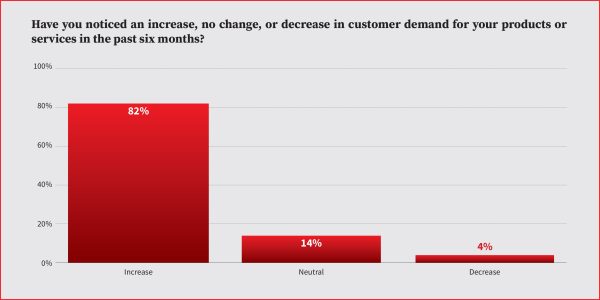

In terms of business demand, companies and organizations are continuing to see growth, with increased demand over the past six months from survey respondents rising from 76% last quarter to 82% in 4Q23.

“Some of the indicators we look for related to the demand for our services are the types of events we book and the booking window,” a convention center general manager based in the Carolinas told Capital Analytics. “When we see booking windows lengthening, it implies consumer confidence. When that window shortens, it indicates uncertainty.”

She added, “The second half of 2023 saw that window expand when the past three years had shorter windows. This is a great indicator.”

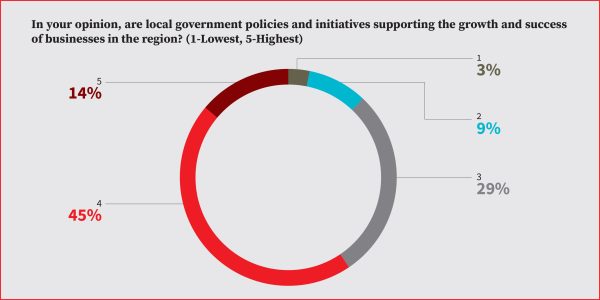

Business and organization leaders’ perspective on government support for business success in regional economies remained mostly unchanged, with 59% of respondents reporting adequate support, a 1% increase from 3Q23.

“Compared to other regions, our government is business-friendly and we have no income tax. If we have problems here, other cities will have bigger problems, so I am pleased to be in this market,” a Dallas-Fort Worth area homebuilder CEO told Capital Analytics.

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.