Writer: Andrea Teran

October 2025 — Southern business leaders report continued strength in company performance and demand, but confidence has cooled slightly in the face of persistent cost volatility and policy uncertainty.

October 2025 — Southern business leaders report continued strength in company performance and demand, but confidence has cooled slightly in the face of persistent cost volatility and policy uncertainty.

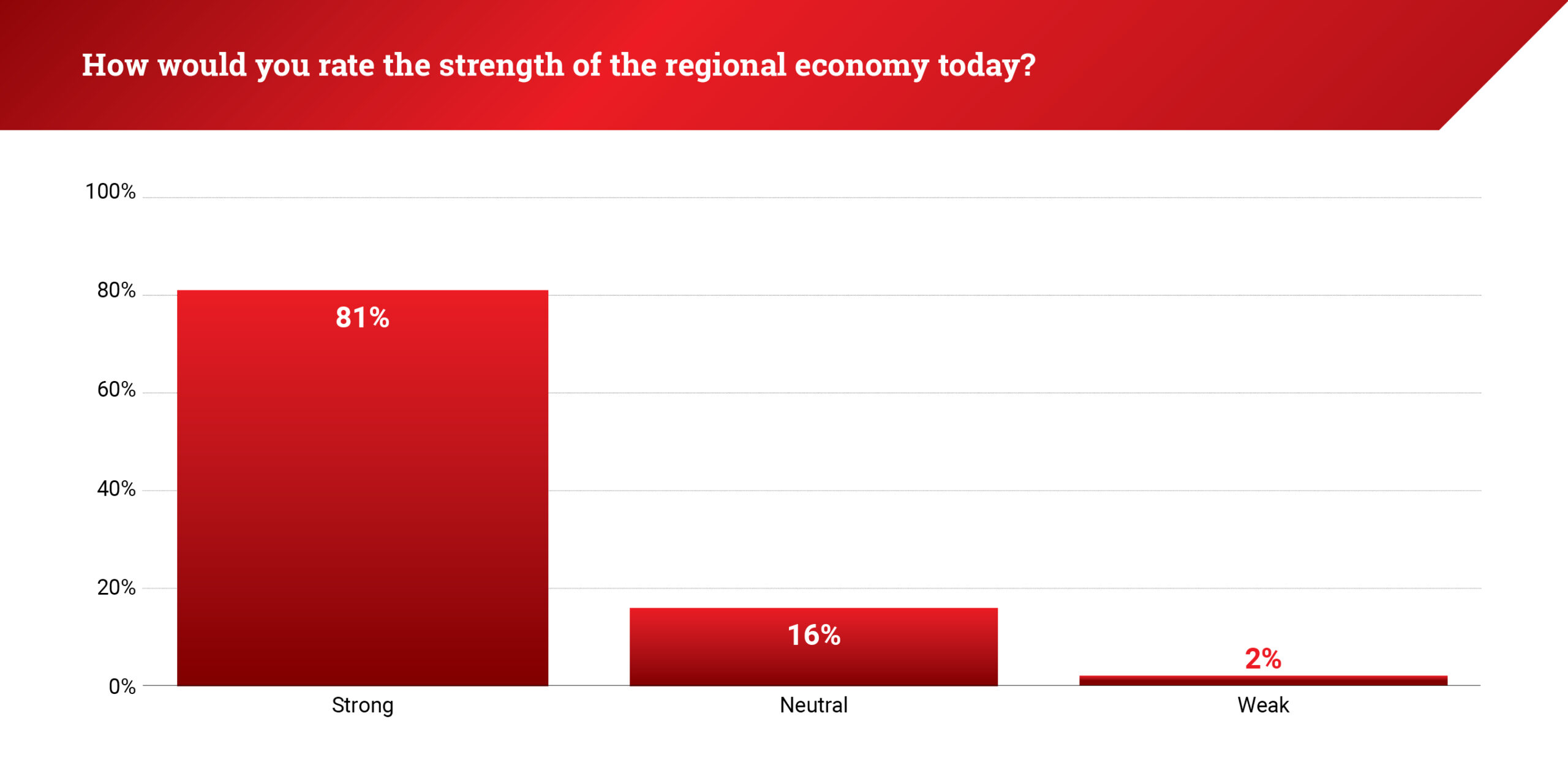

According to caa’s latest Invest: Business Sentiment Survey (I:BSS), 81% of U.S.-based Southern executives rated their regional economy as “strong” (scores of 4 or 5), down from 86% in 2Q25 and 89% in 3Q24.

“We’re fortunate to be in Texas, where the economy has been more insulated than in other regions,” a San Antonio-based engineering executive told caa. “Even if growth slows, we can continue moving forward without significant setbacks because of the diversity of our markets.”

Southern markets continue to outperform the U.S. overall, with an average rating of 4.17 in 3Q25, compared to 3.95 nationally and 3.73 in the North. But the 5-point quarterly drop in strong responses reflects declining optimism as tariffs, rate uncertainty, and rising costs lower economic sentiment.

This resilience stands out amid greater turbulence in the world economy. According to the OECD’s September 2025 Economic Outlook, global GDP growth is projected to slow from 3.3% in 2024 to 2.9% this year and next, with global output expected to rise by just 2.5% through the fourth quarter of 2025. The slowdown is particularly pronounced in the U.S., where GDP is projected to grow by only 1.1% over the year.

This resilience stands out amid greater turbulence in the world economy. According to the OECD’s September 2025 Economic Outlook, global GDP growth is projected to slow from 3.3% in 2024 to 2.9% this year and next, with global output expected to rise by just 2.5% through the fourth quarter of 2025. The slowdown is particularly pronounced in the U.S., where GDP is projected to grow by only 1.1% over the year.

In a bid to support slowing growth, the Federal Reserve cut its benchmark interest rate by 25 basis points in mid-September — the first rate cut since December 2024. This brought the federal funds target to a range of 4.00% to 4.25%. The Fed signaled two additional cuts may follow by year-end. While the move could ease borrowing costs, many executives remain concerned that tariffs, supply chain challenges, and overall volatility may temper any near-term relief.

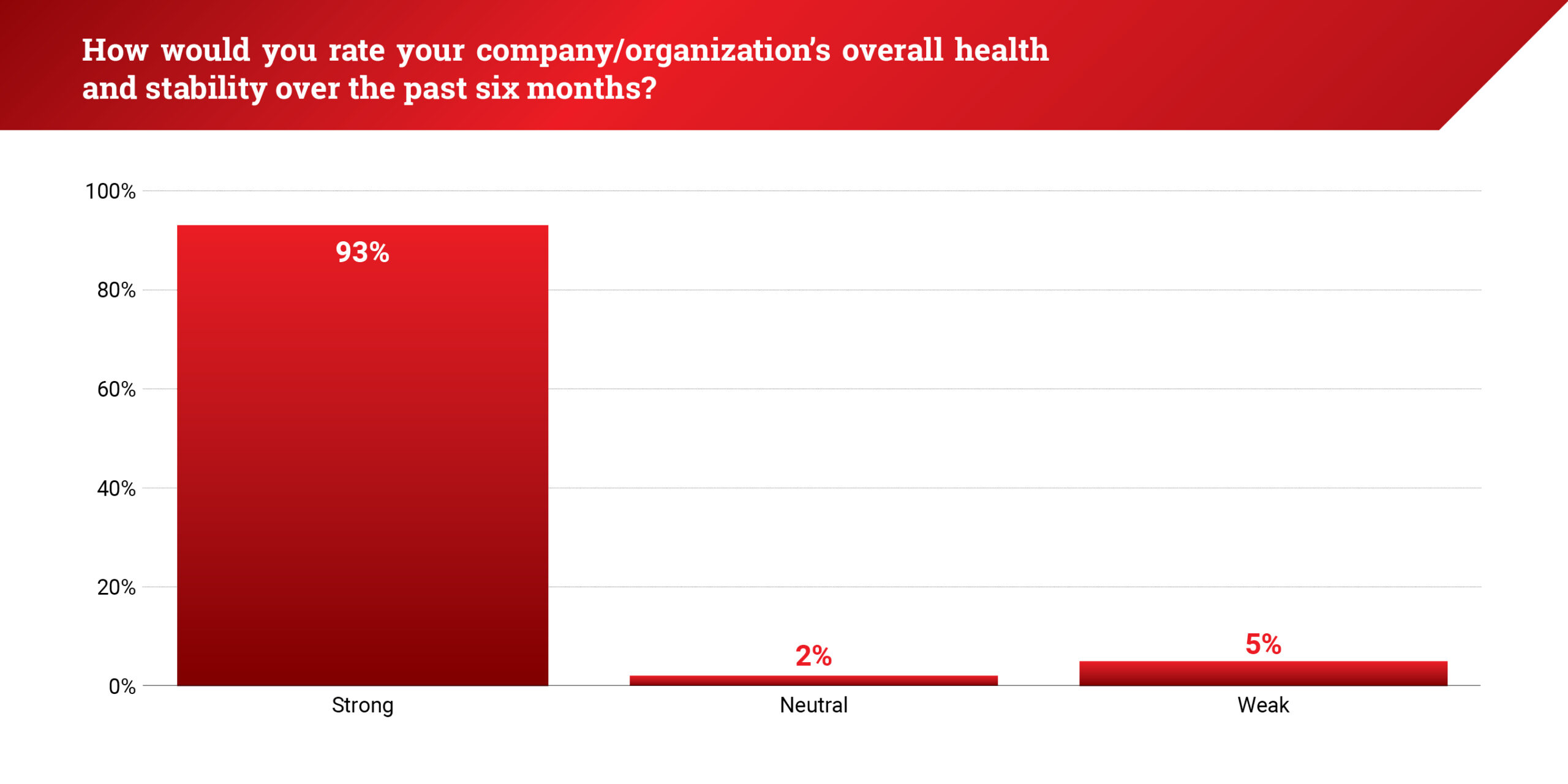

When asked to rate their organization’s overall health over the past six months, 93% of Southern leaders gave a strong rating; up 2 points from the previous quarter and 6 points year over year. This aligns with leaders’ insights from construction, finance, and technology firms.

“Even when clients hesitate due to tariffs or macro uncertainty, we continue to see new project activity almost immediately,” said a Palm Beach-based construction executive. “The market resets and moves forward quickly.”

Perceptions of market strength in the South, however, declined sharply in 3Q25, with 74% of leaders rating current industry conditions positively, down from 94% the prior quarter. Just 2% indicated weakening conditions this quarter.

“We’ve adjusted by staying close to our clients, regularly updating budgets and offering flexible planning,” added a Houston-based engineering and consulting executive.

Inflation expectations have been revised upward by the CBO economic projections, driven largely by tariffs. The PCE price index — the Federal Reserve’s preferred inflation measure — is projected to rise 3.1% in 2025, before easing to 2.4% in 2026 and 2.0% in 2027. Elevated input costs are expected to persist through the near term, aligning with Southern executives’ concerns about pricing volatility. A Houston-based consultant noted, “We’re frequently updating project budgets to reflect material and labor cost shifts; flexibility has become a core part of our client engagement model.”

The U.S. labor market continues to cool. Unemployment rose to 4.3% in September, from 4.1% at the end of 2024, according to the latest figures from the Bureau of Labor Statistics. The CBO anticipates the unemployment rate will continue to rise to 4.5% in 2025 before briefly easing to 4.2% in 2026.

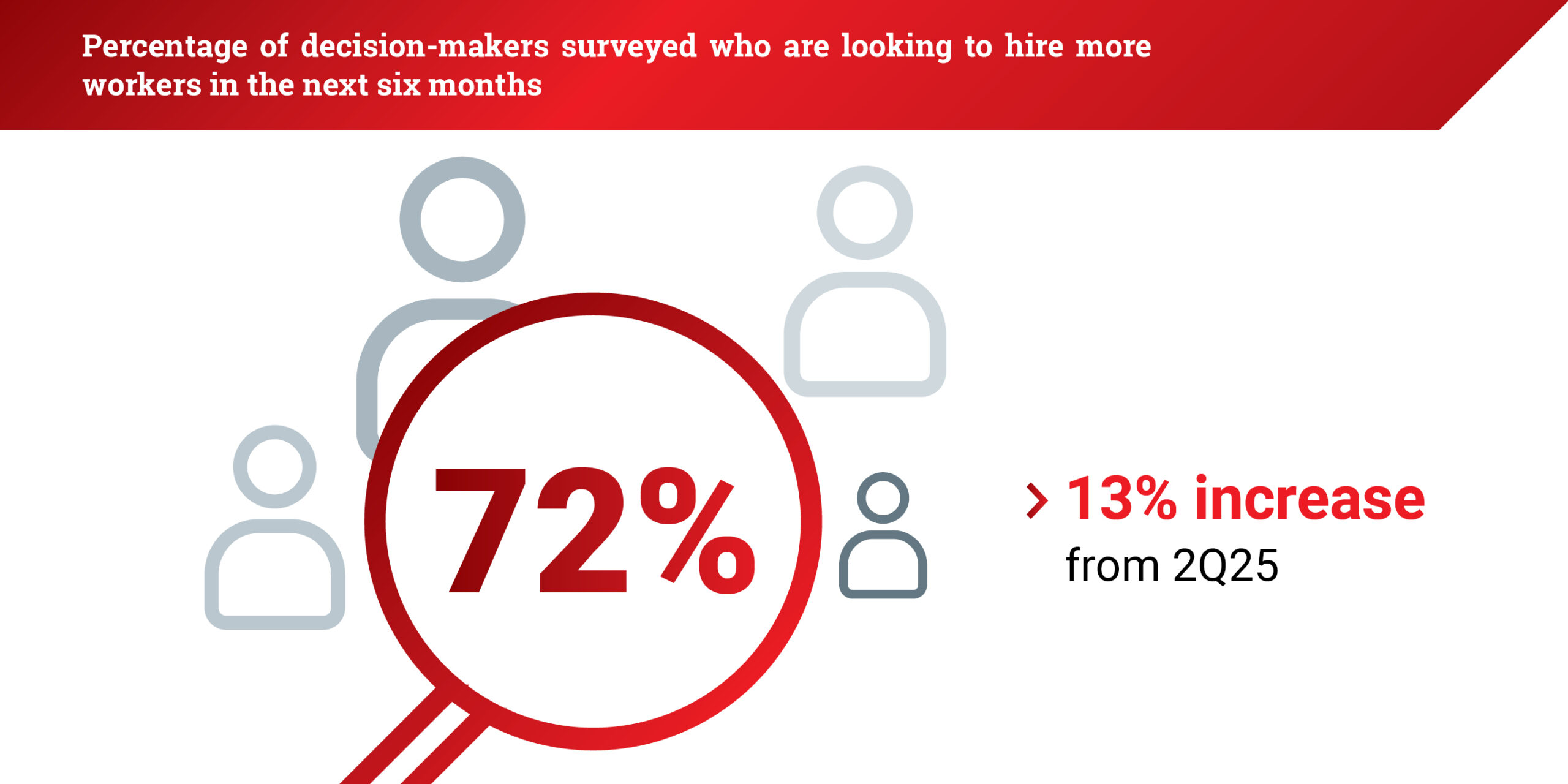

Despite this, 72% of Southern executives say they plan to hire — an increase from the previous quarter, but still 8 points below the same period in 2024 — suggesting businesses remain responsive to labor market tightness while navigating potential softening ahead. Reduced immigration levels are also expected to further limit labor supply, compounding hiring challenges in sectors already facing talent shortages.

“Talent shortages are especially pronounced in the accounting field,” said a Florida-based accounting executive. “We’re working to reframe the profession as one that’s strategic, tech-forward, and deeply client-facing to appeal to the next generation.”

A Houston-based staffing leader echoed the competitive nature of the labor market: “Most small and midsize firms we work with are either backfilling roles or expanding teams. Employers are leaning on hybrid flexibility and mission-driven messaging to stay competitive.”

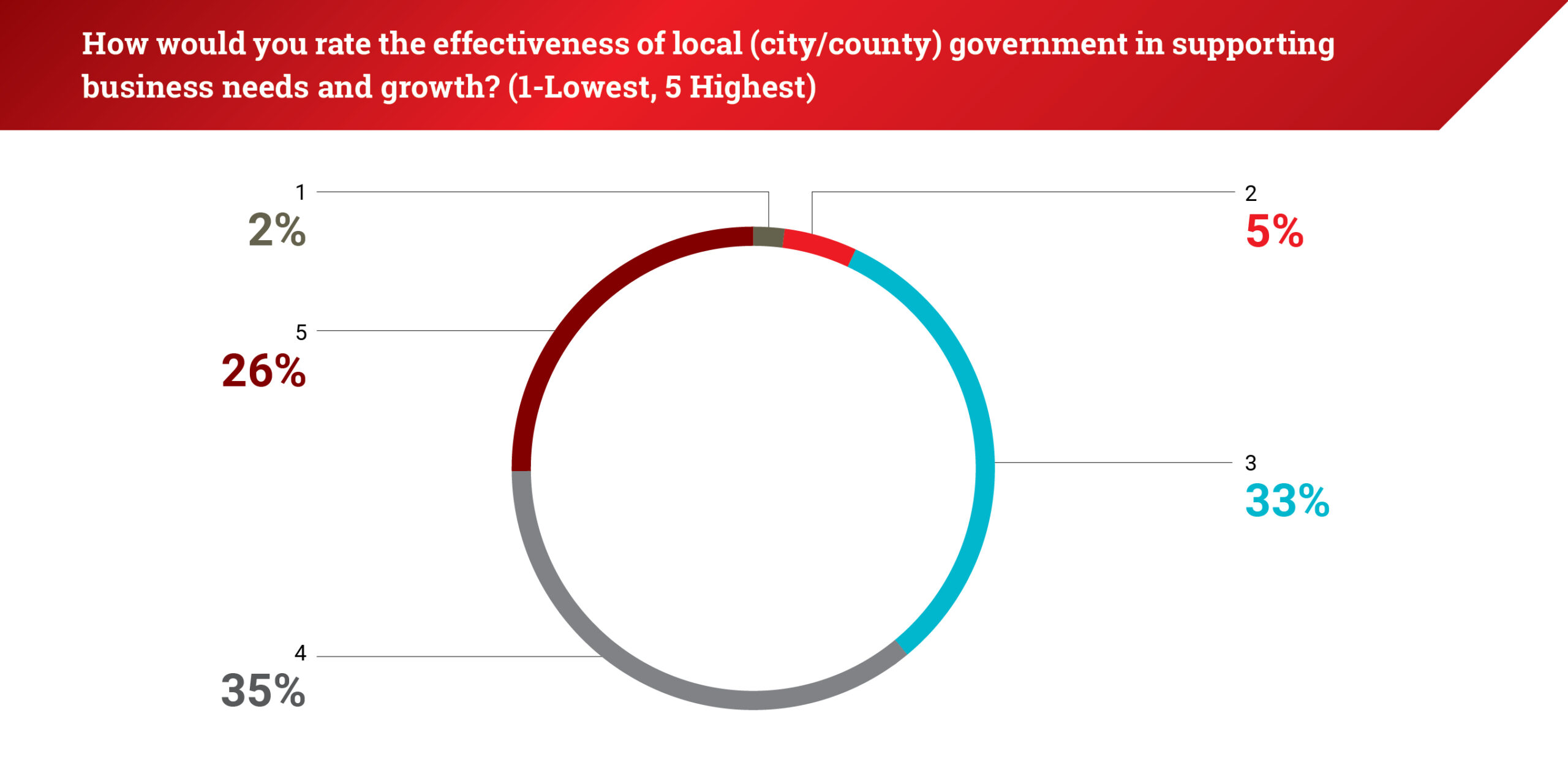

Southern executives remain more satisfied with local government support than their Northern peers. Seventy percent rated local government support as favorable — down from 78% last quarter, but unchanged from the same period in 2024. In contrast, only 46% of Northern respondents rated their local government positively.

“We encourage all our clients, especially small businesses, to engage more directly with local governments,” said a South Florida-based financial services executive. “That dialogue helps ensure policies remain aligned with business needs and market realities.”

Sectors such as energy infrastructure, logistics, and advanced manufacturing remain active. For example, Swiss firm ABB announced a $110 million U.S. manufacturing investment, expanding capacity in Texas to support grid modernization and power-intensive sectors like data centers.

For more I:BSS reports, click here.