US industries brace for casualties amid Trump’s trade war with China

Writer: Mirella Franzese

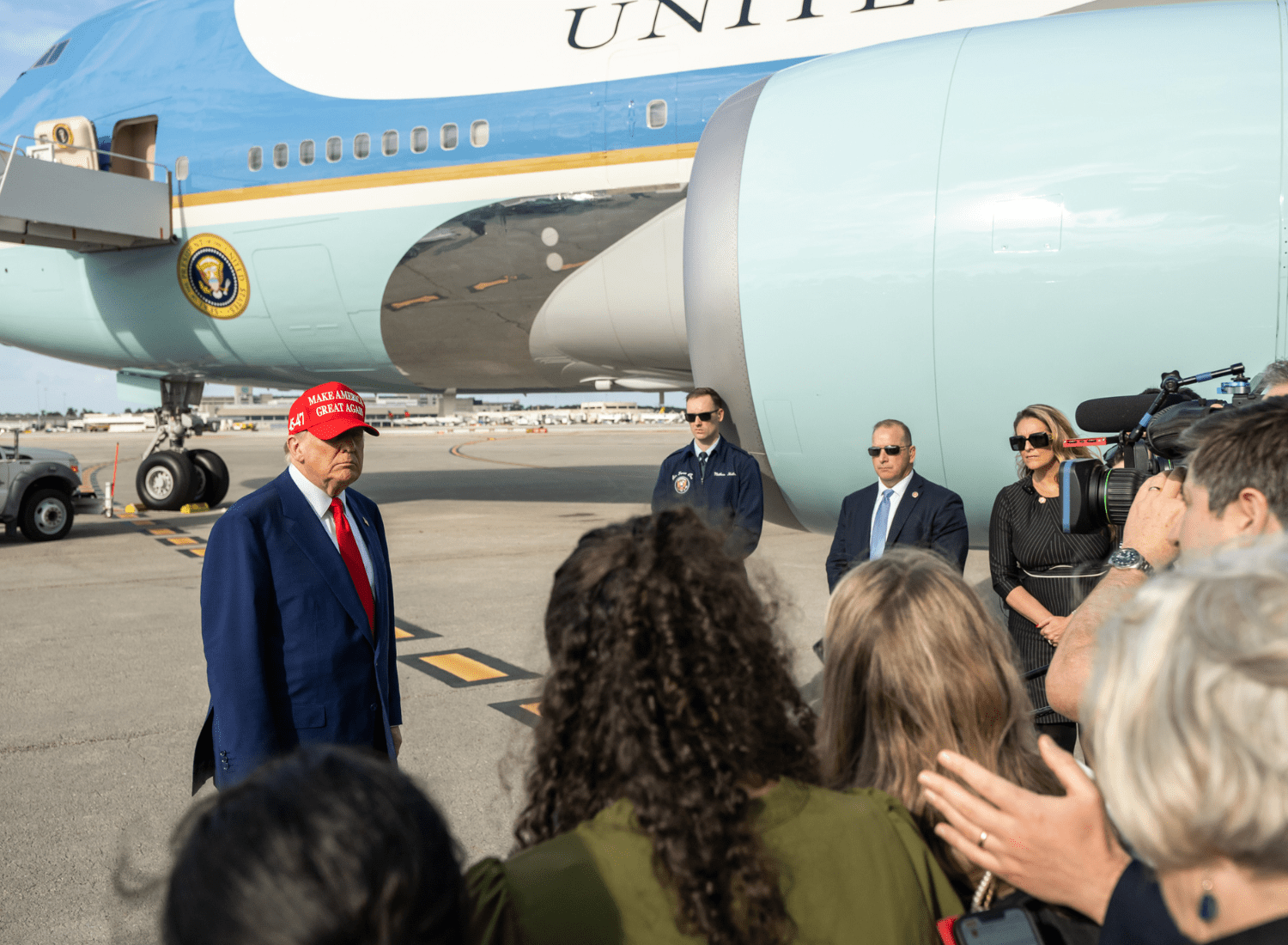

3 min read February 2025 — Less than a month into his second term, President Donald Trump is delivering on a campaign promise to administer tariffs on global trade partners. Earlier this month, the Trump administration imposed an additional 10% tariff on all Chinese imports, setting off a new trade war between the world’s two largest economies that could carry significant implications for U.S. businesses.

3 min read February 2025 — Less than a month into his second term, President Donald Trump is delivering on a campaign promise to administer tariffs on global trade partners. Earlier this month, the Trump administration imposed an additional 10% tariff on all Chinese imports, setting off a new trade war between the world’s two largest economies that could carry significant implications for U.S. businesses.

“They charge us a tax or tariff and we charge them the exact same,” said Trump to reporters following the announcement earlier this month. Overall, though, China’s tariffs currently amount to $14 billion worth of U.S. imports, while American tariffs represent $525 billion worth of China-produced goods, according to data from Goldman Sachs, published by The Washington Post.

In response, Beijing announced 10-15% tariffs on select American goods, namely crude oil, liquefied natural gas, and agricultural machinery.

Trump’s “Fair and Reciprocal Plan” sets out to restore fairness in U.S. trade relationships by countering non-reciprocal trading arrangements and closing out the annual American import-export deficit while bolstering domestic industries and bringing back jobs to U.S. soil.

The new administration is also set to decide on whether or not to follow through on the threat of 25% tariffs against Mexico and Canada — a measure that was agreed to be put on hold for 30 days after separate diplomatic talks between Canadian Prime Minister Justin Trudeau, Mexican President Claudia Sheinbaum, and Trump.

With more than $1.3 trillion in U.S. imports, or half of all American trade, coming directly from Canada, Mexico, and China, the implications of an all-out trade war are significant.

“It’s a no-win situation when we impose tariffs on our neighbors in Canada and Mexico, both of whom supply important products and technologies to the United States,” Peter Connolly, CEO of New Jersey Manufacturing Extension Program, told Invest:.

Economists believe that global trade tensions between the United States and China will result in higher levels of inflation, slower economic growth, loss of jobs, and disruption of supply chain operations for both countries. “Tariffs are inherently a tax paid by U.S. consumers,” said Nick Marro, global trade lead at the Economist Intelligence Unit (EIU), to DW.

Because the U.S. economy is highly intertwined with neighboring countries Canada and Mexico, as well as a reliance on China for tech-related goods, these new tariffs could reduce total U.S. imports by 15%, which translates to a $195 billion cut, according to data from Bloomberg Economics.

More specifically, trade tensions with China could affect the cost of common consumer products, such as clothes and shoes, kitchen products, appliances, furniture, and automobile parts.

The American electronics category may also be vulnerable to sharp price increases as phones and computers make up the bulk of U.S. imports from China — amounting to $55 billion and $40 billion, respectively. American businesses may be implicated as well, since Apple and other large-scale tech corporations depend on China for the production and assembly of its tech products, further implicating businesses.

Trump’s economic dispute with Mexico and Canada, two of the largest suppliers of crude oil imports to the United States, is likely to impact key domestic industries, including automotive, energy, and agriculture. While the manufacturing and steel industries are expected to remain largely unaffected due to protectionist policies, tariffs levied against Mexico and Canada, two of the largest suppliers of crude oil imports to the United States, could lead to huge surges in gas prices, corresponding to a 50-cent increase per gallon in the Midwest. This primary sector of the U.S. economy is also expected to be affected as Mexico supplies over 60% of all U.S. vegetable imports and just under 50% of fruit and nut imports.

The national housing shortage may also magnify as the U.S. imports key construction materials (from lumber to cement products) from Mexico and Canada each year.

“These looming tariffs, while intended to protect domestic industries, risk further exacerbating the housing supply and affordability crisis while stifling the development of new housing” as a result of “the severe housing shortage, compounded by rising construction costs, persistent supply chain disruptions, and an estimated shortfall of 6 million homes,” wrote U.S. Congressional Democrats in a letter to Trump, as cited by The Guardian.

Other global markets have also been caught in the crosshairs of the new administration, with Trump threatening 10% tariffs against the European Union — one of the United States’ major exporters of automobile, medical, and agricultural products.

In the financial markets, the reignited trade war between China and the United States is expected to cause currency manipulations and foreign exchange volatility, leading to money devaluation for emerging markets with currencies pegged to the dollar. (The Chinese yuan is trading at 7.27 to the dollar, hovering near its weakest level since 2008.)

According to Stephen Miran, an investment strategist at Hudson Bay Capital Management, tariffs weaken the exporting country’s currency and purchasing power, thereby shifting most of the economic cost away from American consumers and onto China.

“Since the exporters’ citizens [become] poorer as a result of the currency move, the exporting nation ‘pays for’ or bears the burden of the tax, while in the U.S., the treasury collects the revenue,” said Miran in a Politico article.

Even so, tariffed countries are likely to retaliate against such measures, meaning American businesses, investors, and consumers would inevitably be forced to shoulder the economic burden of higher production costs.

“U.S. importers cannot absorb the added costs indefinitely and may go out of business unless they find new suppliers or pass those costs to consumers, who may then need to cut back on spending,” wrote Nancy Qian, professor of economics at Northwestern University, in an analysis published by the Australian Strategic Polity Institute.

Top image via The White House/Wikimedia

For more information, please visit: