Writer: Jerrica DuBois

January 2025 — Business leaders in the Northern markets covered by Capital Analytics’ annual business reviews remained positive on the local economy and their businesses in the second quarter ended in December, according to the latest Capital Analytics Business Sentiment Survey (CABSS).

January 2025 — Business leaders in the Northern markets covered by Capital Analytics’ annual business reviews remained positive on the local economy and their businesses in the second quarter ended in December, according to the latest Capital Analytics Business Sentiment Survey (CABSS).

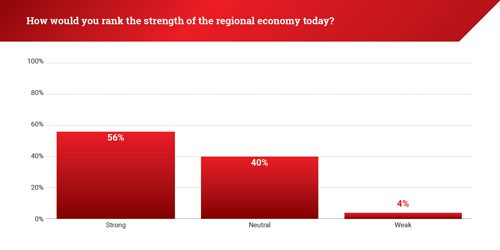

The Q4 CABSS revealed that 56% of respondents viewed the strength of their regional economy positively, a 7% increase from 4Q23. Meanwhile, 4% reported a weaker view of the economy, and 40% have a neutral outlook, up from 25% in 3Q24.

“Our university system and the industrial revolution have made this region attractive for business expansion, as ‘the bones’ of our infrastructure are ripe for redevelopment. We’re seeing more businesses repurposing old textile mills for logistics centers and lofts and former corporate campuses once occupied by the companies of prior decades into new live/work/place communities. The national political environment, with incentives for domestic production, only strengthens this appeal,” an accounting executive in Boston told Capital Analytics.

Sentiment in the poll aligns with the Federal Reserve’s recent FOMC statement, which highlighted solid economic expansion, eased labor market conditions, and an increased, yet still low unemployment rate. The assessments also take into account inflation pressures and expectations, and financial and international developments. The Fed has lowered the federal funds rate target range from 4.50% to 4.25%, saying that the risks to achieving employment and inflation goals are in balance. The FOMC remains highly attentive to inflation risks and is committed to returning inflation to its 2% objective.

Respondents in the CABSS rated their sentiment on a scale of 1 to 5 (5 being the highest), with an average score of 3.58 out of 5. This marks a decline from the 3.86 average score in 3Q24.

“Over the last year, we’ve seen significant activity in our land use and real estate group. The workload in this area has increased steadily and continues to do so,” a law firm executive in Minneapolis-St. Paul told Capital Analytics. “As interest rates begin to drop, we expect this trend to accelerate, as it typically leads to increased development activity. That, in turn, will drive demand for our services in land use and real estate law.”

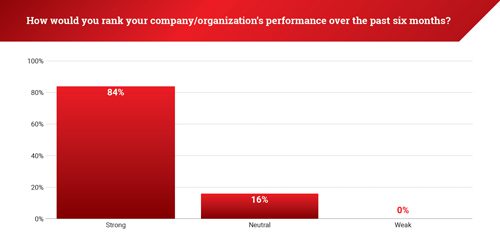

Of the business leaders surveyed in the Northern markets, 84% across all industries indicated growth and strong company performance, although this is down slightly from the previous quarter, with 88% reporting positive company results in 3Q24.

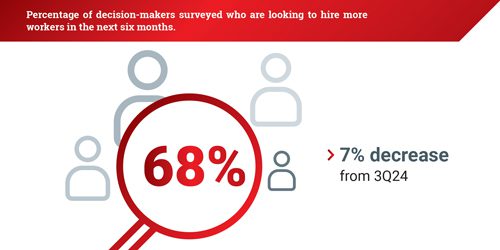

The labor market remains a focal point, with 68% of decision-makers planning to hire more workers, which is unchanged from 4Q23. This suggests a stable outlook for companies’ growth, but it is also an indicator of the challenges companies continue to have in finding talent. Although many industries continue to face decisive staffing hurdles, leaders are hopeful that the tide is turning.

“To address the staffing challenge, we focus on networking and building relationships with hospitality schools to tap into students who are entering the industry,” a hospitality leader in Boston shared with Capital Analytics. “Recruitment goes beyond just filling positions; it’s about ensuring we hire the right people for hospitality — people who have a passion for the sector and want to grow in their careers. Identifying future leaders is a key focus for us as we continue to build our team.”

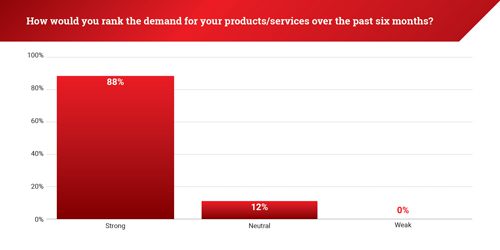

When discussing market demand, 88% of respondents reported increased demand for their products and services, an increase of 7% from last quarter and a 3% from 4Q23. The sustained high demand underscores the resilience of the Northern markets. To continue to meet this demand, businesses need to push their focus toward effective resource management and strategic planning.

When discussing market demand, 88% of respondents reported increased demand for their products and services, an increase of 7% from last quarter and a 3% from 4Q23. The sustained high demand underscores the resilience of the Northern markets. To continue to meet this demand, businesses need to push their focus toward effective resource management and strategic planning.

“The workforce needs are skyrocketing for highly skilled employees with technical training. Our students often have multiple job offers before they graduate,” a higher education leader in Minneapolis-St. Paul told Capital Analytics. “We offer day and night programs to fit into our students’ schedule so they can work while they go to school. I am proud to report that we have seen significant enrollment increases — 25% over the summer and over 16% this fall. Part of this growth comes from our expanded programs, but we are also seeing a shift in perception around technical education within our communities.”

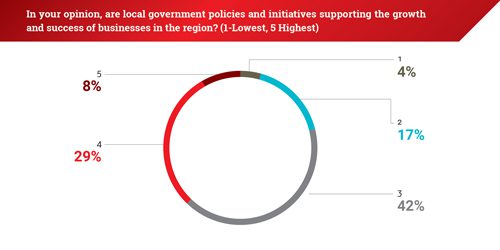

Sentiment toward government policies was the only contrast in the latest survey, with 37% of respondents expressing positive views on government support for business growth, down from 53% in 3Q24. Negative sentiment increased slightly from 20% to 21%, while those who remained neutral jumped from 26.7% last quarter to 42%.

“The regulatory environment has become increasingly complicated and expensive to navigate. Regulators continue to add more and more requirements, some of which conflict with one another. Governmental tracking, compliance, and documentation has become more complex, requiring additional technology and staffing to manage it,” a banking CEO said to Capital Analytics.

For more CABSS reports, click here.