Writer: Ryan Gandolfo

3 min read January 2024 – In the last quarter of 2023, the latest Capital Analytics Business Sentiment Survey (CABSS) revealed a divide in prevailing and emerging trends between the Northern and Southern United States coming into 2024.

3 min read January 2024 – In the last quarter of 2023, the latest Capital Analytics Business Sentiment Survey (CABSS) revealed a divide in prevailing and emerging trends between the Northern and Southern United States coming into 2024.

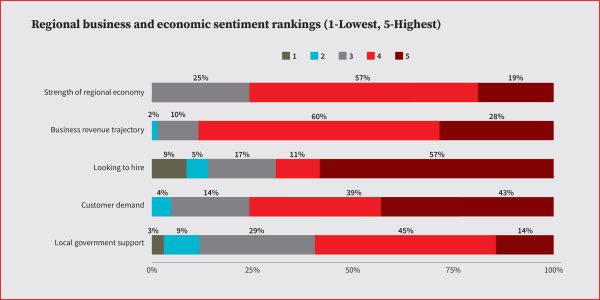

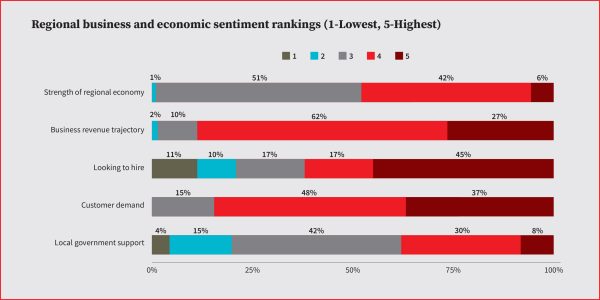

In survey responses from public and private sector leaders in markets covered by Capital Analytics’ annual economic reports, from October 2023 through December 2023, market leaders ranked the strength of their regional economy 3.83 out of 5 (5 being the highest), on average. Southern market leaders held more favorable views, with 76% of respondents ranking their area economy 4 or 5, while 48% of Northern market leaders shared the same positive sentiment.

“Over the past year, we’ve continued to grow our business in the region. Our existing financial advisors have gained new assets and we’ve also hired multiple financial advisor teams in both our Philadelphia and nearby suburban offices,” one Philadelphia-based wealth management market executive told Capital Analytics. “These developments have us extremely excited about our wealth management capabilities, with our continued focus and growth in this market.”

The majority of Northern leaders who participated in CABSS 4Q23 survey expressed a neutral viewpoint regarding the current strength of their regional economy, with 51% ranking their area economies 3 out of 5.

Speakers at the Invest: Boston Launch Conference confirmed the viewpoints conveyed in the CABSS and were similarly divided by region. “Massachusetts is expensive for living and doing business. CNBC ranked us 49th for business costs and 47th for living costs mainly due to housing prices,” said JD Chesloff, president and CEO of Massachusetts Business Roundtable. “Together, we can continue to make this city and state wonderful places to live, work, and do business.”

In terms of business revenue trajectory, both Northern and Southern market leaders expressed overall positive sentiment, with 89% and 88% respectively, ranking projected revenues in the coming six months at 4 or higher.

“Business travel is on the rise, a crucial aspect for any destination, providing a consistent stream of activity. We maintained an average occupancy rate of 61% in the initial ten months of 2023, marking a positive 6.8% growth compared to the previous year,” a Houston area hotel manager told Capital Analytics. “These figures are promising, and projections indicate a continuation of this trend into 2024.”

Meanwhile, some companies further North are less ambitious on the hiring front, with 21% of survey respondents ranking hiring expectations over the next six months at 2 or less, compared to 14% in Southern markets. Among Boston area banking and professional services executives, outmigration and a lacking talent pipeline were both mentioned as growing concerns.

Demand for products and services in both Northern and Southern markets remained strong, with 85% and 82% of respondents ranking their demand at 4 or higher, respectively. “We’ve received a strong response to our event and entertainment-related services, such as express services to sports events and special occasions,” a Tennessee transportation leader shared with Capital Analytics, noting tourists constitute nearly one in 10 of their total ridership.

The largest disparity between Northern and Southern market leaders pertained to viewpoints on local government support for businesses, as the majority of respondents (59%) in Southern markets ranked support at a 4 or higher while Northern market leaders’ positive sentiment (38%) scored markedly lower.

For an in-depth analysis of CABSS 4Q23 findings, visit our Northern and Southern reports.