Writer: Mirella Franzese

October 2025 — In the third quarter of 2025, business sentiment across major Northern metro areas showed signs of modest recovery, buoyed by growing optimism in the regional economy and corporate performance. However, economic sentiment and perceptions of government support continued to lag, according to the latest Invest: Business Sentiment Survey (I:BSS).

October 2025 — In the third quarter of 2025, business sentiment across major Northern metro areas showed signs of modest recovery, buoyed by growing optimism in the regional economy and corporate performance. However, economic sentiment and perceptions of government support continued to lag, according to the latest Invest: Business Sentiment Survey (I:BSS).

“There’s a bit of uncertainty right now. We have good news and bad news economically, and we aren’t quite sure where we are landing,” a New Jersey hospitality leader told Invest:.

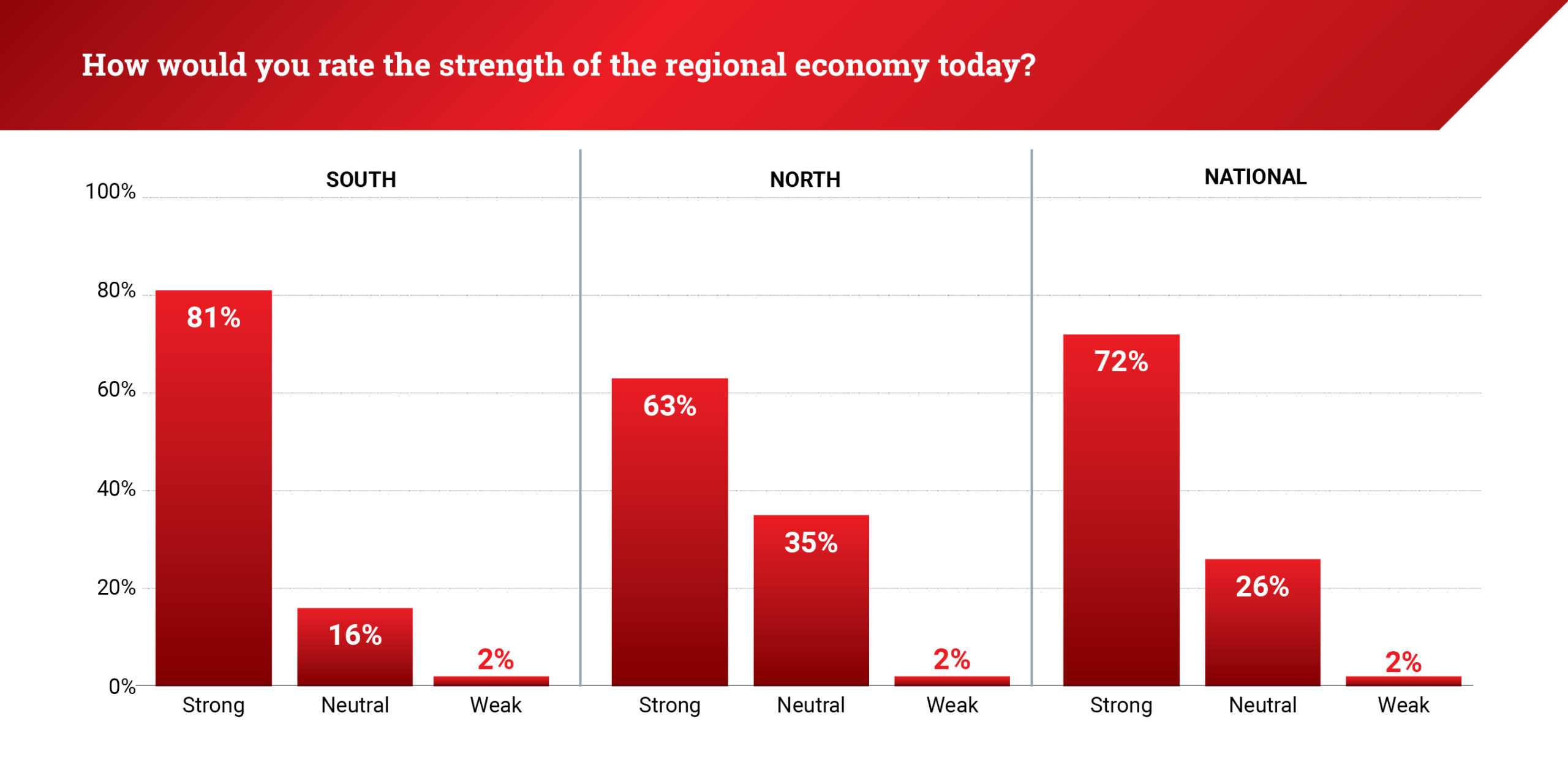

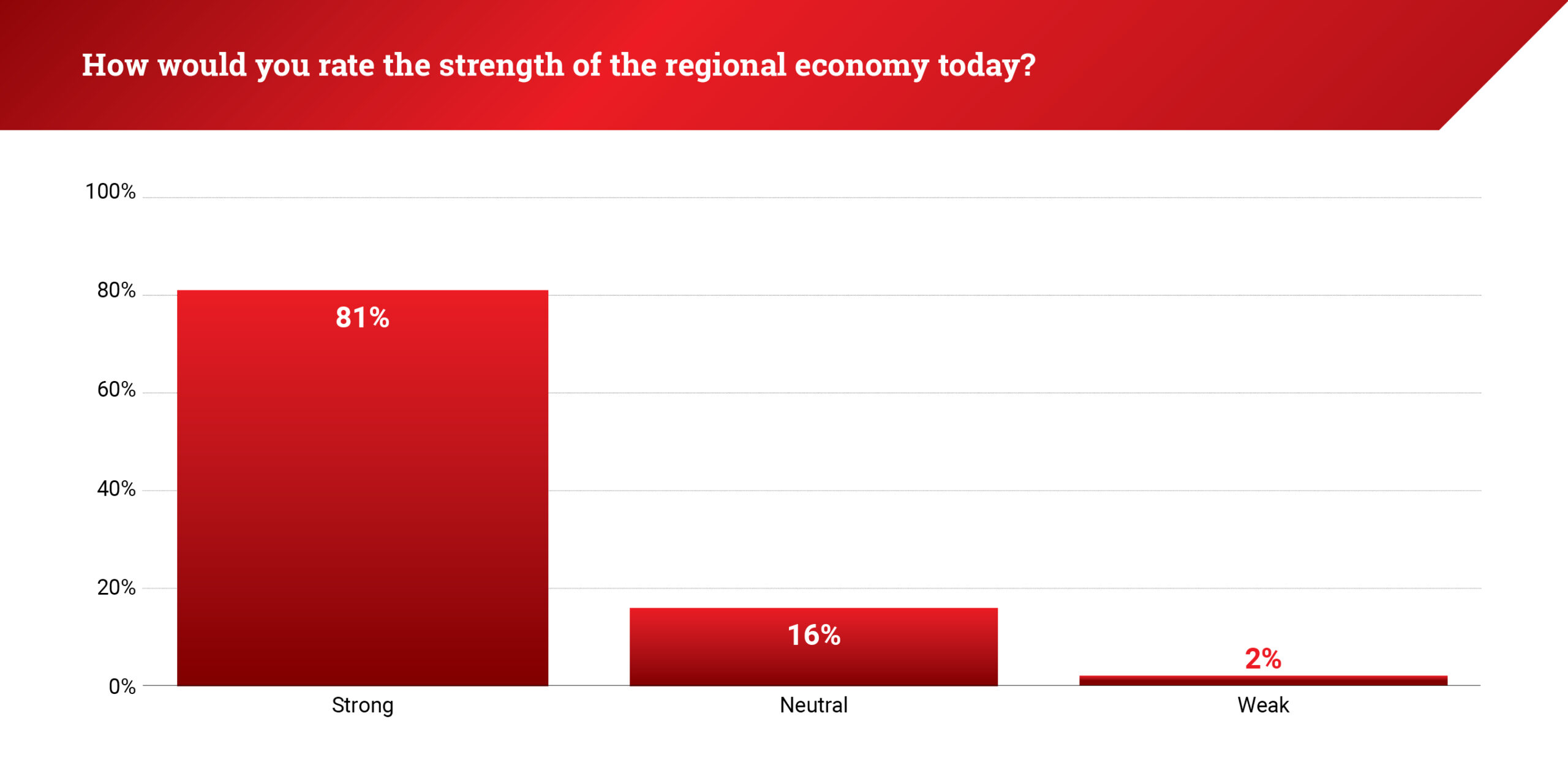

Confidence across regional economies grew by 5% this quarter, with 63% of surveyed executives rating current conditions as “strong.” (Respondents rated various economic factors on a scale of 1 to 5, with 5 being the highest). Despite improving expectations, regional market sentiment remains down 12% year-over-year, reflecting continued instability and an unclear economic outlook.

“Over the last year, the primary challenge has been the economy’s uncertainty,” explained a New Jersey-based bank CEO to Invest:. “The unpredictability of factors such as tariffs and regulatory changes emerging from Washington, D.C., made it a worrisome period.”

Economic sentiment among Northern business leaders (3.73) trailed the national average of 3.95 in 3Q25, which was largely buoyed by a strong 4.17 average in Southern markets like Atlanta, Charlotte, and Houston.

While national and Southern average scores remained mostly unchanged from the previous quarter, Northern economic sentiment rose by 0.12 points, indicating growing optimism. The uptick is partly attributed to the region’s key industries and upcoming economic drivers, including the 2026 FIFA World Cup, which is expected to boost infrastructure, tourism, and hospitality.

“Philadelphia remains a community with immense potential,” a Pennsylvania-based banking executive told Invest:. “The region has a diverse economy: strong “eds and meds,” vibrant sports culture, and excellent transportation links that make it a great place to live, work, and grow. Major events like next year’s semiquincentennial celebration, the MLB All-Star Game, and multiple FIFA fixtures will further showcase the city.”

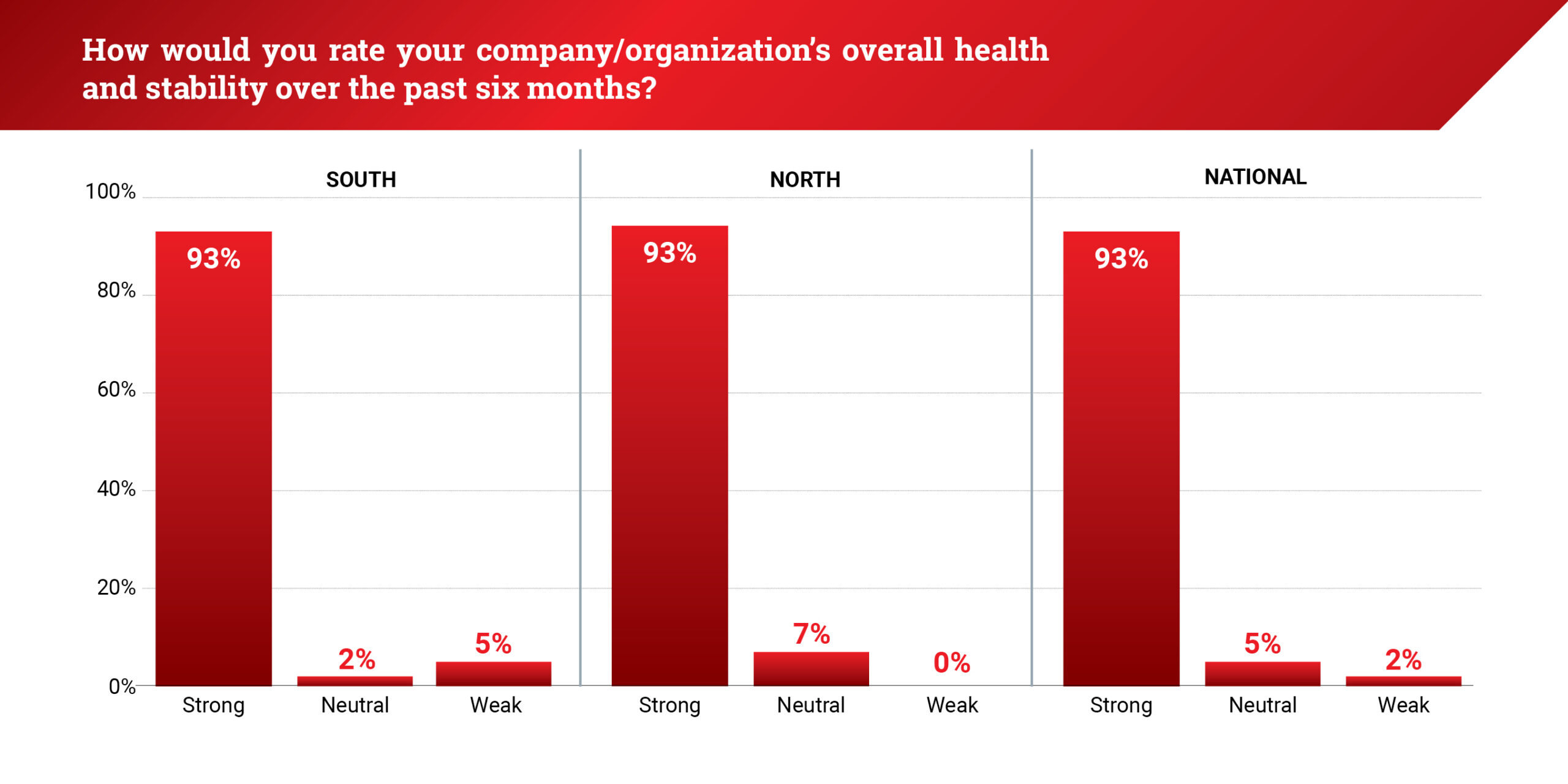

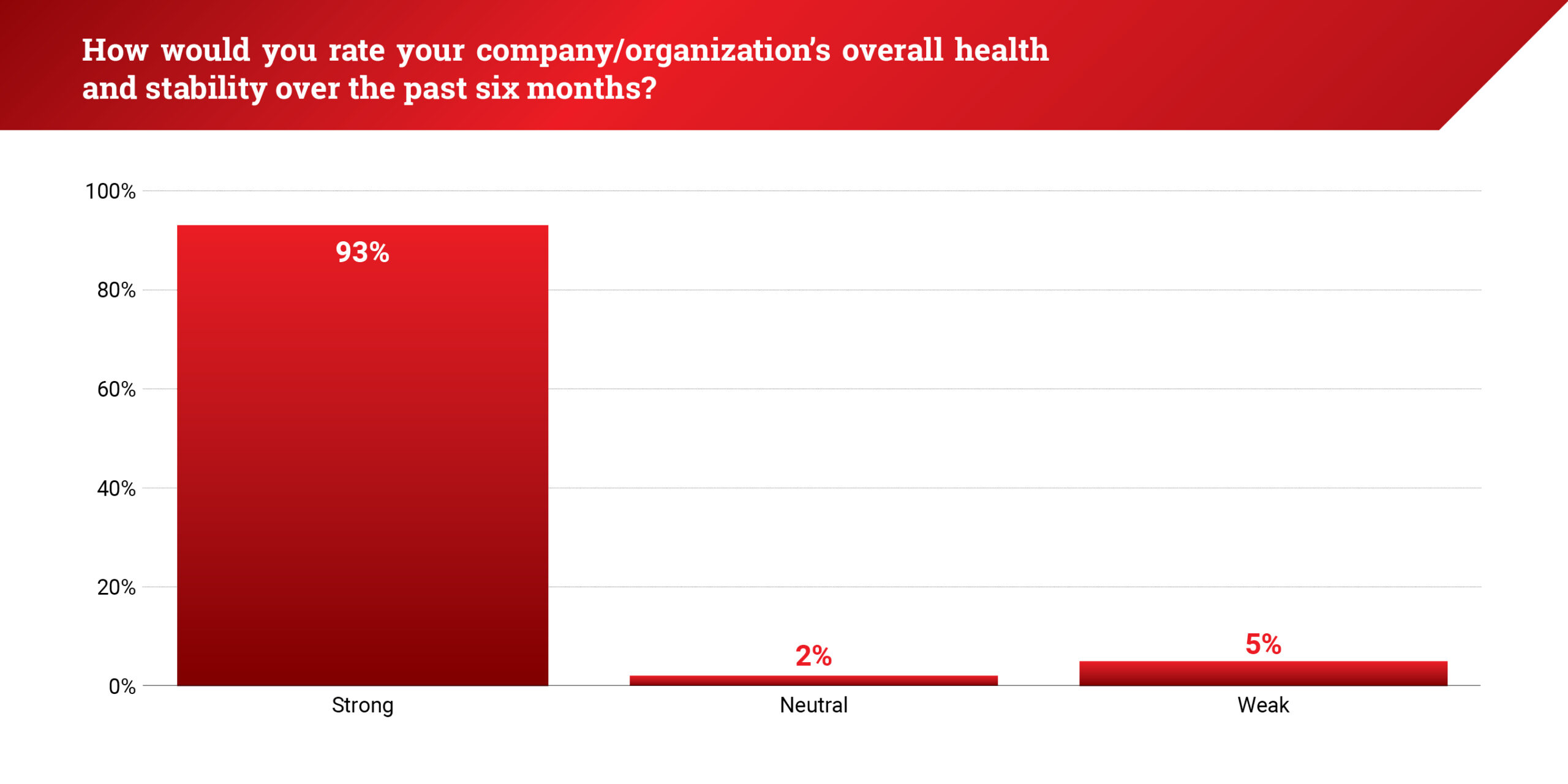

Positivity extended to perceptions of company health and stability despite shifting market conditions. Corporate sentiment skewed positive, with 93% of respondents in the North rating their company’s performance as “strong,” compared to just 90% in the previous quarter and 88% a year earlier.

In Northern markets, hiring intent remains steady despite a cooling labor market. About 79% of decision-makers plan to hire in the next six months, a 6% increase from the previous quarter (73% in 2Q25) and a 4% rise year over year (75% in 3Q24). Nationally, 75% of businesses are planning to increase their headcount.

As companies continue investing in technology and AI, demand for tech-specific roles has emerged as a regional bright spot, particularly in professional services, contributing to the hiring momentum across the North.

“The timeline for hiring technology positions happens faster than in construction,” a Pennsylvania contractor CEO told Invest:. “We’ve seen a lot of growth in the technology sector, and companies are coming here to set up shop and utilize the talent pool.”

“Leveraging the tech stacks would enable us to reach economies of scale,” said the managing director of a New Jersey accounting firm. “A lot of CPA firms.. are hiring accountants or ….more non-accountants who are focused on information systems, data analytics, and technology capable of producing data links and data mining, which is necessary for our consulting services.”

Despite a moderate hiring appetite, market conditions remain uneven across sectors, with 68% of leaders in the South and North reporting favorable performance. Sectors such as construction continue to face the effects of elevated interest rates, making development harder to finance and further affecting housing costs, affordability, and workforce development in the region.

“Many private development projects are highly sensitive to interest rates,” a Philadelphia builder told Invest:. “Over the past two years, there’s been a lot of waiting and hoping for meaningful rate reductions, which haven’t materialized.”

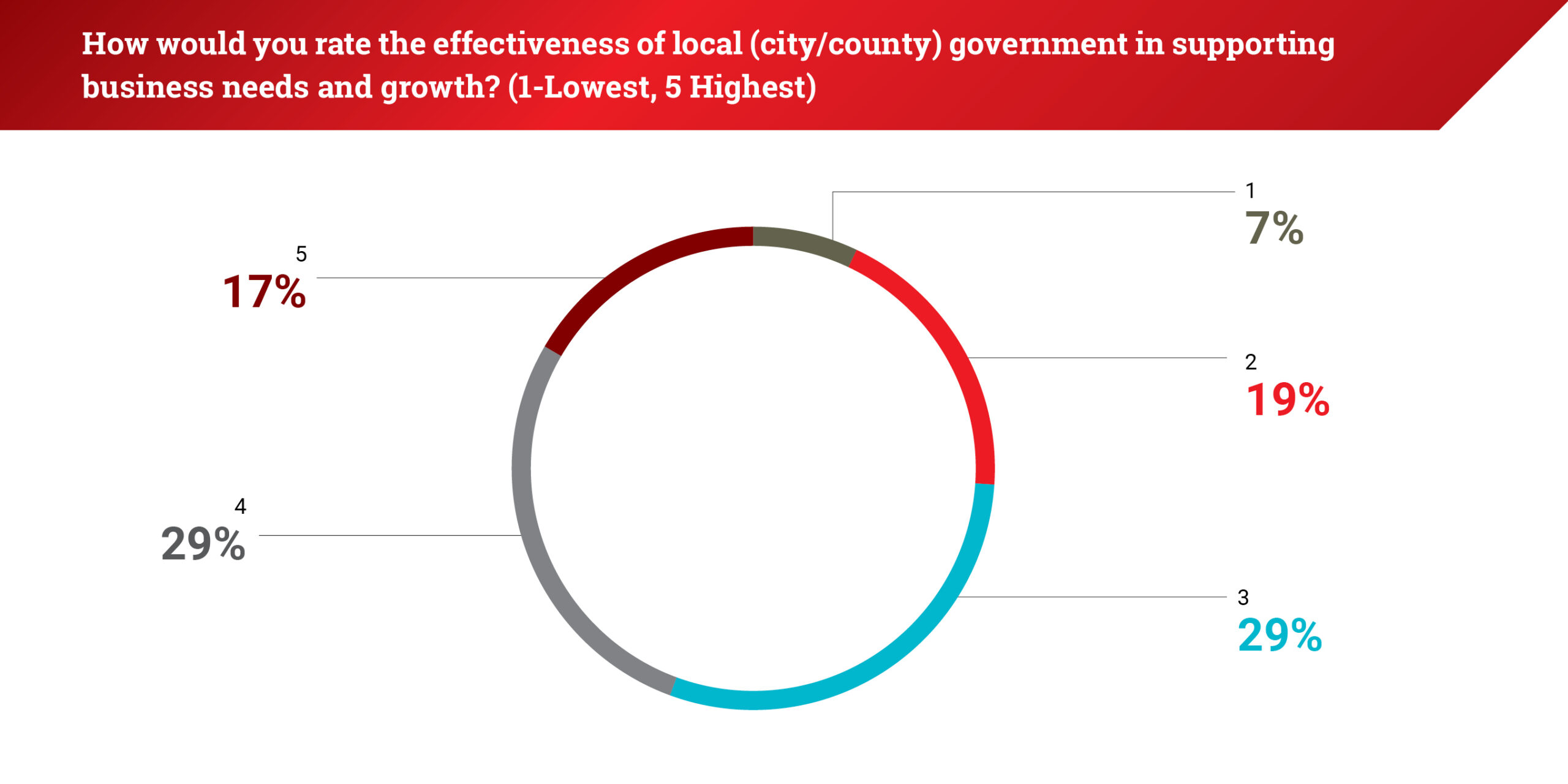

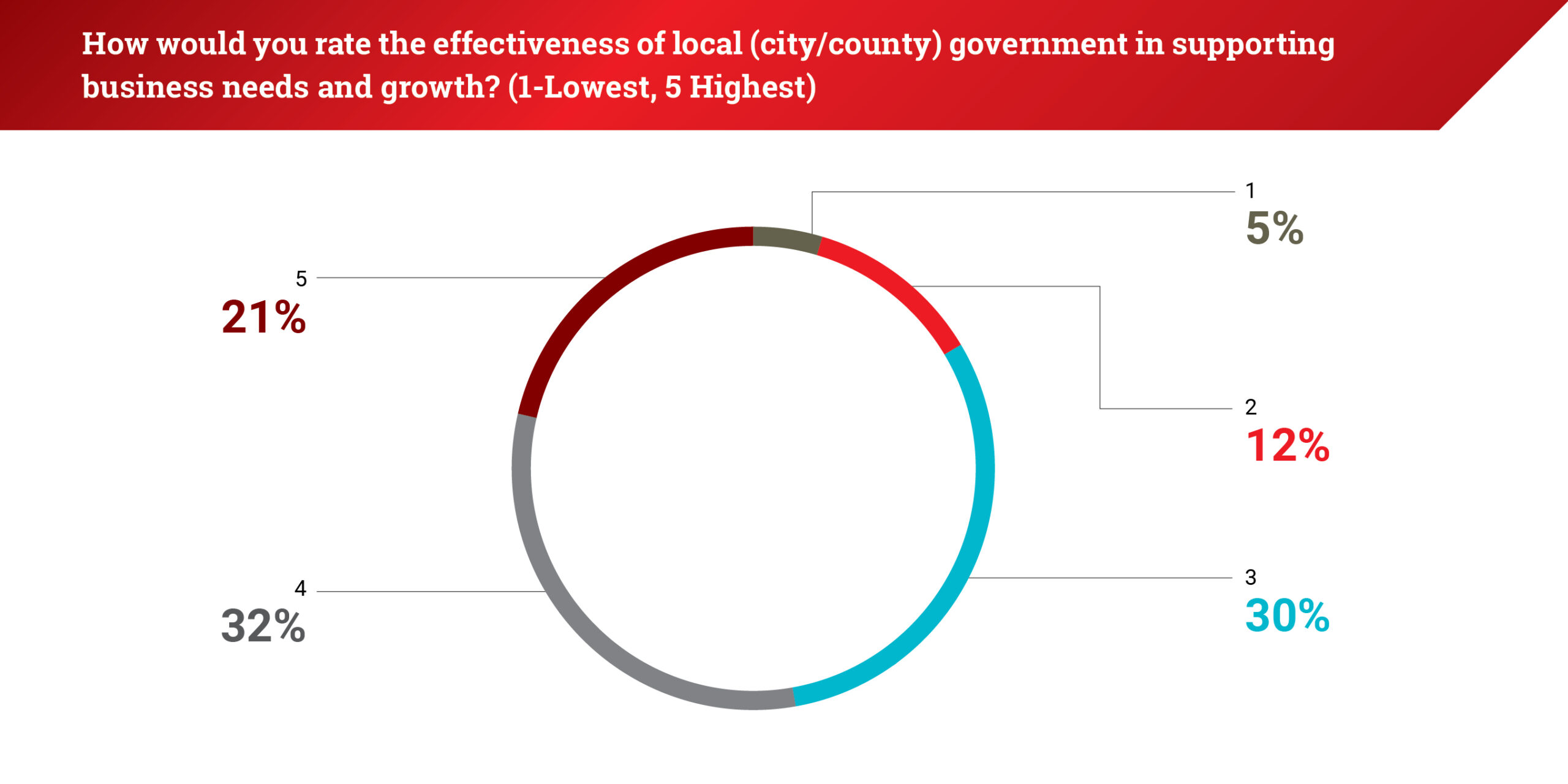

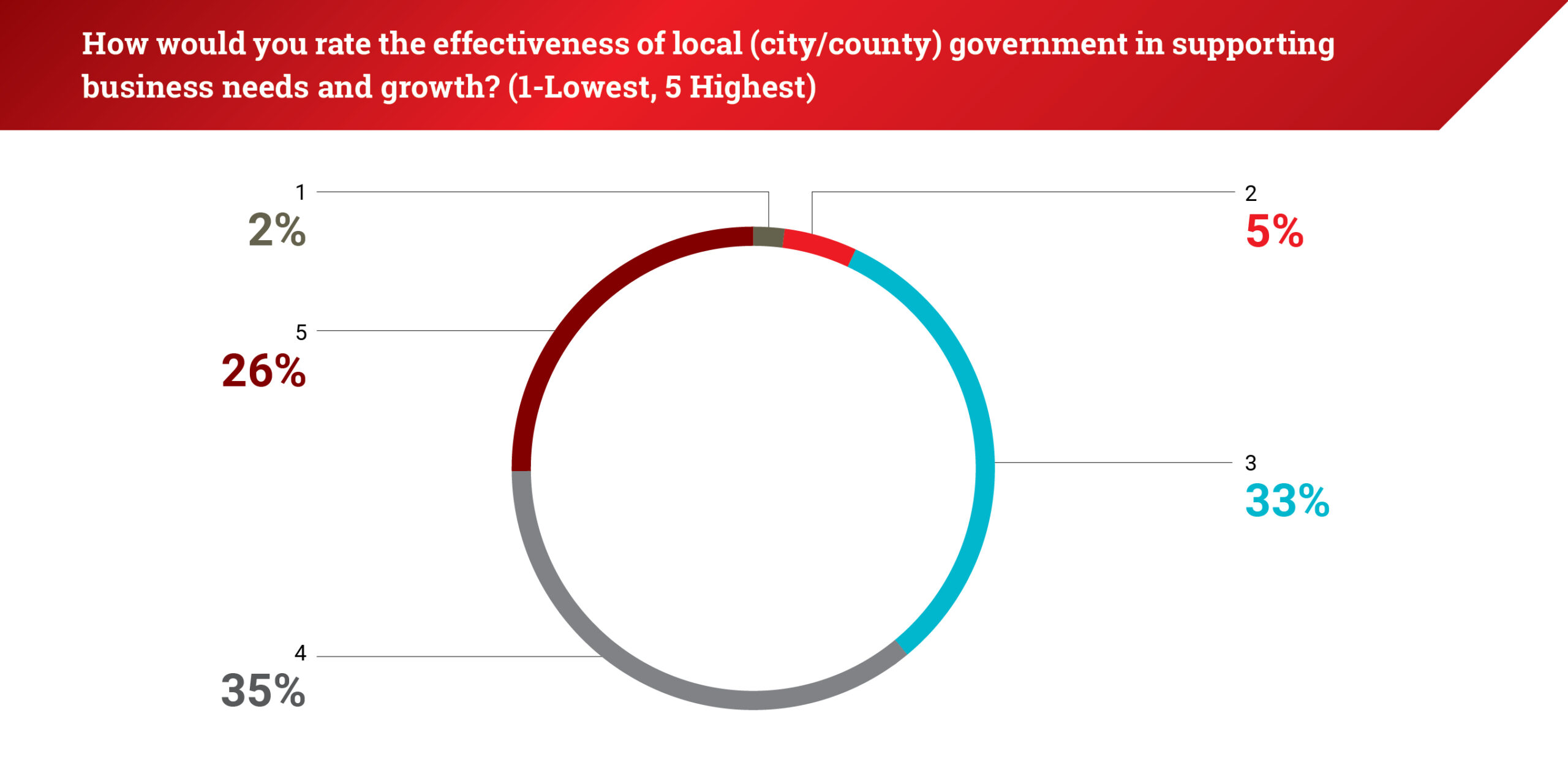

At the same time, perceptions of local government performance diverge significantly between regions. Just under half of Northern executives (46%) rated their local government’s ability to support businesses as “strong,” showing little change quarter over quarter. In the South, by comparison, 70% of respondents expressed a positive view of local government support.

For more I:BSS reports, click here.

Subscribe to Our Newsletters

"*" indicates required fields

Chris Cera, CEO of Arcweb Technologies

Chris Cera, CEO of Arcweb Technologies Aran McCarthy, president of FCArchitects

Aran McCarthy, president of FCArchitects Susanne Svizeny, executive vice president and chief C&I banking officer of OceanFirst Bank

Susanne Svizeny, executive vice president and chief C&I banking officer of OceanFirst Bank Youseff Tannous, market president for Eastern Pennsylvania at KeyBank

Youseff Tannous, market president for Eastern Pennsylvania at KeyBank Marc Tepper, head of the Philadelphia office at Buchanan Ingersoll & Rooney

Marc Tepper, head of the Philadelphia office at Buchanan Ingersoll & Rooney