Writer: Eleana Teran

July 2024 — Business leaders in the Southern markets covered by Capital Analytics’ annual business reviews maintained their positive economic sentiment in 2Q24, according to the latest Capital Analytics Business Sentiment Survey (CABSS).

July 2024 — Business leaders in the Southern markets covered by Capital Analytics’ annual business reviews maintained their positive economic sentiment in 2Q24, according to the latest Capital Analytics Business Sentiment Survey (CABSS).

The survey shows that 88% of respondents view their regional economy positively, an 11 percentage point increase from the 77% recorded in 1Q24. Twelve percent of respondents maintain a neutral stance, a decrease from 21% in the previous quarter, and none see it as weak, down from 2% who viewed it negatively last quarter.

Respondents rated their sentiment on a scale of 1 to 5 (5 being the highest), with the average score among all respondents rising to 4.21 out of 5.

Encapsulating the positive regional outlook, a leader in urban development noted, “A success for 2024 has been shifting our focus to getting infrastructure in the ground. The infrastructure projects we already have in the pipeline and approved range from a two-way street conversion, currently under construction, to restoring two-way traffic on previously one-way streets, park construction, and more. These projects take time and have become a priority because they will help reduce the need for incentives. Once these projects are in service, adjacent developments can recognize the rent rate, minimizing the necessity for incentives.”

Read more: CABSS: Optimism steady among Northern markets businesses

Recent indicators suggest that economic activity has continued to expand at a solid pace, with job gains remaining strong and the unemployment rate staying low. The Federal Open Market Committee (FOMC) projects real gross domestic product (GDP) growth at 2.1% in 2024, and 2% in the next two years. The unemployment rate is expected to be around 4.0% in 2024, rising slightly to 4.2% by 2026.

While inflation has eased, it continues to be elevated, with the PCE index anticipated to be 2.6% in 2024, decreasing to 2.0% by 2026. These projections reflect a balanced approach to achieving maximum employment and stable prices over the next couple of years. In response, the Federal Reserve’s recent FOMC statement emphasized that it will carefully assess incoming data and the evolving outlook before making any further adjustments to its benchmark interest rate, with a strong commitment to returning inflation to its 2% objective. Consequently, the federal funds rate target range has been maintained at 5.25% to 5.50%.

An executive from a regional business alliance said, “One significant goal is to grow the economy. To illustrate, the region announced nearly 5,500 job opportunities last year, alongside a $4 billion capital investment. From the perspective of economic growth, we are quite satisfied with these results.”

In the Southern markets, business leaders are optimistic about potential growth, with 86% of surveyed leaders anticipating increased revenues in the next six months, a slight uptick from the high expectations of the previous quarter.

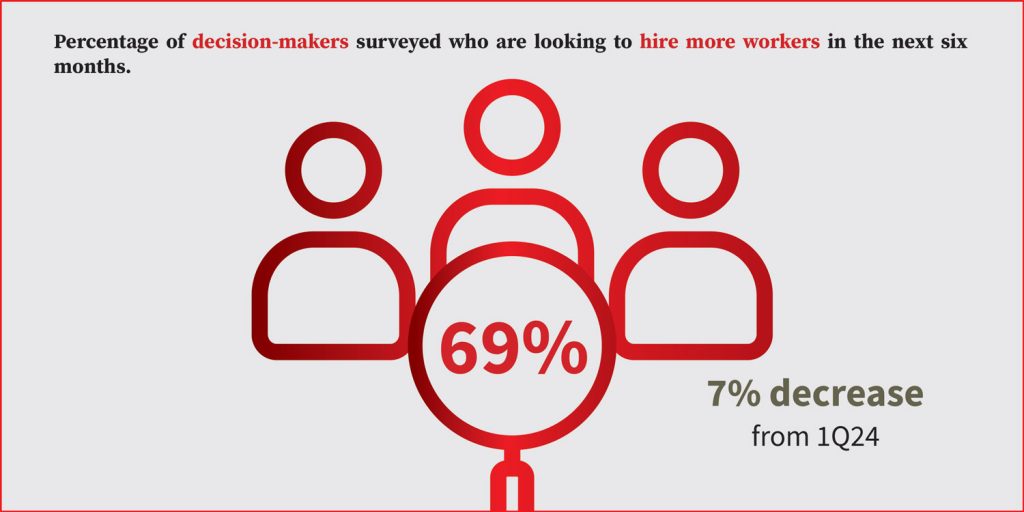

The labor market continues to be a major focus, with 69% of decision-makers planning to hire more workers, a slight decrease from last year – 71% of respondents in 2Q23 were gearing up to expand their workforce – reflecting their strategic talent planning and the ongoing challenges some industries are facing.

“Change is inevitable and must be embraced. Employers are demanding more productivity and output from fewer employees, as demographic shifts have reduced the available workforce. This increased demand for productivity coincides with the need for flexibility and work-life balance, which many younger and older workers alike are requesting,” an HR specialist told Capital Analytics. “Businesses are exploring flexible scheduling rather than reducing hours, ensuring continuous operation while meeting employee needs for a better work-life balance.”

Over the preceding six months to June, 85% of respondents reported higher demand for their products and services, a slight decrease for the comparable period in the 1Q24 poll at 90%. This sustained high demand underscores the resilience of the Southern markets.

“2023 saw a significant downturn, with our real estate transaction volume dropping by about 60%, a trend consistent with the broader healthcare real estate sector. This decline was influenced by higher interest rates, which complicated financing and affected real estate valuations. Our approach has been cautious; we have not focused on pursuing growth for its own sake or overpaying for assets. Despite the reduced deployment of capital into real estate in 2023 and continuing into 2024, other business areas, such as property management and engineering, have experienced substantial growth. This diversification has kept our business robust, even as the investment landscape has shifted,” a leader in the healthcare real estate sector said.

Sentiment toward government policies presents a mixed picture and remains consistent with the past quarter, with 63% of respondents expressing positive views on government support for business growth. This is a slight drop from last year, where 2Q23 showed 68% of respondents had a favorable view of government support of local businesses.

“We were excited that the business rent tax was reduced from 4.5% down to 2%. That will be very beneficial to our local businesses. Hopefully, they will continue to drop that and eliminate it next year or the year after,” said a Florida leader.

Read more: CABSS: Q2 business sentiment steady despite uncertainty

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.