Writer: Andrea Teran

July 2024 — Business leaders in the Northern markets covered by Capital Analytics’ annual business reviews remained positive on the local economy and their businesses in the second quarter ended in June, according to the latest Capital Analytics Business Sentiment Survey (CABSS).

July 2024 — Business leaders in the Northern markets covered by Capital Analytics’ annual business reviews remained positive on the local economy and their businesses in the second quarter ended in June, according to the latest Capital Analytics Business Sentiment Survey (CABSS).

The Q2 CABSS revealed that 62% of respondents viewed their regional economy positively, a 2% increase from the previous quarter. Meanwhile, 35% of respondents maintained a neutral stance, and only 3% have a negative outlook, down from 4% in 1Q24.

“We’re concluding a record year with significant growth across all our sectors. It’s a success that mirrors the trends in both the local and national markets,” an accounting executive told Capital Analytics.

Read more: CABSS: Southern markets show sustained optimism

Sentiment in the poll aligns with the Federal Reserve’s recent FOMC statement, which highlighted solid economic activity, strong job gains, and a low unemployment rate. While inflation has eased over the past year, it remains elevated. The Fed has maintained the federal funds rate target range at 5.25% to 5.50%, citing improved balance in the risks to achieving employment and inflation goals. Despite the uncertain economic outlook, the FOMC remains highly attentive to inflation risks and committed to returning inflation to its 2% objective.

Respondents in the CABSS rated their sentiment on a scale of 1 to 5 (5 being the highest), with the average score among all respondents rising to 3.70 out of 5. This marks an improvement from the 3.62 average score in 1Q24.

“Economic challenges definitely have an impact on our market, and flexibility and creativity are big parts of the answer to this problem,” a president in the construction industry told Capital Analytics.

In the Northern markets, business leaders remained positive on growth: 85% of surveyed business leaders across all industries anticipate revenue growth in the next six months. This is up 24% year over year, with 61% of those surveyed responding favorably in 2Q23.

“We want to continue to grow and foster an environment that allows our people to grow and creates opportunities for them. There’s tremendous opportunity in the market, and we want to capitalize on that,” an accounting and advisory firm leader told Capital Analytics.

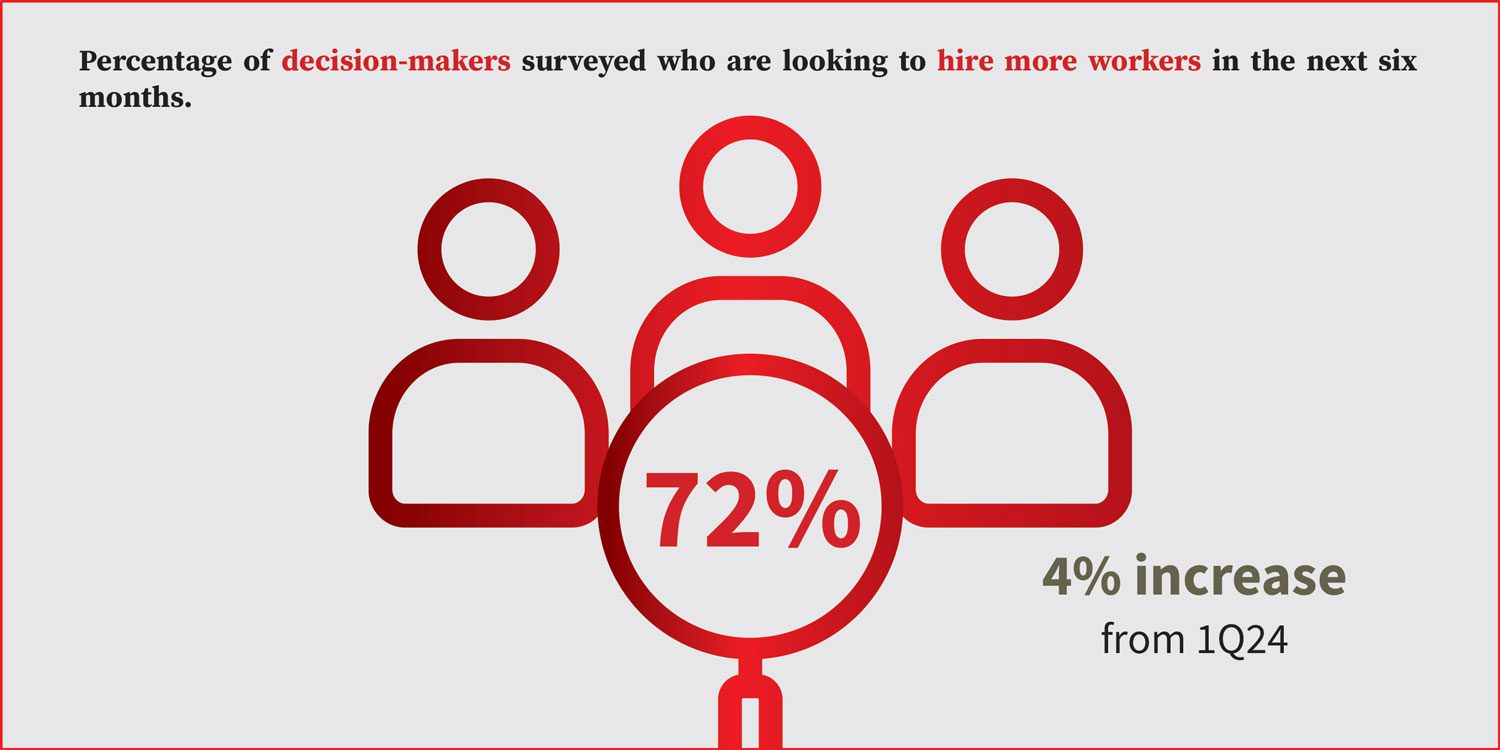

The labor market remains a focal point, with 72% of decision-makers planning to hire more workers, a 4-point increase from 68% in 1Q24. This suggests a positive outlook for companies’ growth, but it is also an indicator of the challenges companies are having in finding talent. Although many industries continue to face decisive staffing challenges, leaders are hopeful that the tide is turning.

“Staffing remains a major issue, although it has slightly improved from two years ago. Finding the right people for the right jobs continues to be a significant hurdle,” a chamber of commerce leader told Capital Analytics. “Addressing childcare is crucial for enabling more parents, especially mothers, to rejoin the workforce, which would alleviate some of these challenges.”

In the past six months, 86% of respondents reported increased demand for their products and services, dipping slightly from 1Q24, but up 11% from 2Q23. The sustained high demand underscores the resilience of the Northern markets. To continue to meet this demand, businesses need to push their focus toward effective resource management and strategic planning.

Sentiment toward government policies was the only contrast, with 39% of respondents expressing positive views on government support for business growth, down from 47% in 2Q23. Negative sentiment decreased slightly from 28% to 22%, while those who remained neutral jumped from 25% in 2Q23 to 39%.

“There is considerable uncertainty stemming from congressional delays in addressing tax regulatory changes. Specifically, we are awaiting clarity on sunset provisions related to tax alterations enacted during the last administration, which could significantly impact clients’ planning strategies,” an accounting executive said to Capital Analytics.

Read more: CABSS: Q2 business sentiment steady despite uncertainty

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.