Writer: Mirella Franzese

January 2025 — U.S. Southern business sentiment remained strong throughout the fourth quarter of 2024, reflecting sustained confidence in regional economies across the United States as a new administration is set to take office, according to Capital Analytics’ latest quarterly business sentiment survey (CABSS).

January 2025 — U.S. Southern business sentiment remained strong throughout the fourth quarter of 2024, reflecting sustained confidence in regional economies across the United States as a new administration is set to take office, according to Capital Analytics’ latest quarterly business sentiment survey (CABSS).

“Businesses are watching the rising cost of construction, which impacts our ability to develop more workforce housing,” said a South Florida-based business development leader in an interview with invest:. “While we are watching movement on the national level, I think we’ve been fortunate to not see any dips or major recessionary events in Palm Beach County. The cost of insurance is also affecting how much development can be done.”

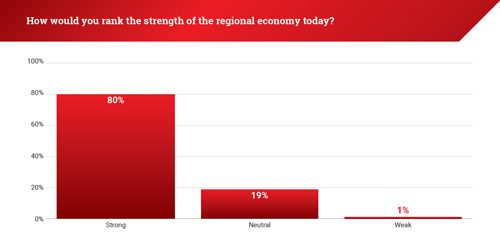

Among the 100-plus industry leaders surveyed in Southern markets, four in five (80%) rated their regional economy as strong while 19% remained neutral and only 1% weak. This rating, which is scored on a sliding scale of one to five, represents a dip in overall sentiment compared to 3Q24, which saw 87% of respondents take a strong stance. Compared to Northern markets, however, Southern business sentiment remains moderately high, given that only 56% of market executives in the North provided a strong rating.

While positive about the near-term, Southern market respondents also cautioned against rising economic pressures and threats — such as the high costs of construction, rising interest rates, and inflation.

“Inflation has been a factor (…) but it’s something we’ve adapted to by consistently revising our plans based on market data. Prices have begun to stabilize, which helps with budgeting and forecasting,” a construction executive from West Florida told Invest:.

Market response to U.S. election results was favorable with the expectation that the new administration will take a more business-friendly stance and build on the Southern region’s growth through incentives and trade legislation.

READ MORE: What a second Trump presidency means for U.S. businesses

“The election also provided much-needed clarity. It’s given buyers confidence, which is essential for us as developers. Ultimately, nothing gets built unless people are willing to buy. Knowing that buyers are confident allows us to move forward with projects that align with market demand,” said the executive.

Perceived company performance over the last six months remained strong, with 84% ranking their company performance 4 or 5.

Optimism within the labor market is evident with executives across multiple industries sharing plans to grow staff over the next six months. Among survey participants, 77% expressed a high likelihood of hiring more full-time staff in the next six months — only a modest dip from the previous quarter.

In contrast, S&P Global’s Economic Outlook U.S. Q4 2024: Growth And Rates Start Shifting To Neutral report identified sluggishness in the housing and manufacturing industries as reasons for less favorable perception in company performance and reduced demand for hiring. “The recent loosening of the labor market indicates a normalization, as opposed to a U.S. economy that’s about to slip into recession. An expansion of the labor force, rather than a fall in employment, has spurred the rise in the unemployment rate up to now — a key difference from previous cycles at the start of a recession,” stated the report. However, the outlook for the near-term U.S. economy remains strong despite moderating growth.

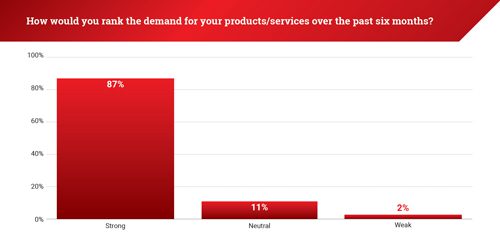

Demand for products and services over the past six months proved resilient in the CABSS survey — consistent with the growth projected in the S&P Global report. Eighty-seven percent of respondents expressed an increase in demand for their products and services over the latter half of the year, while 11% took a neutral stance.

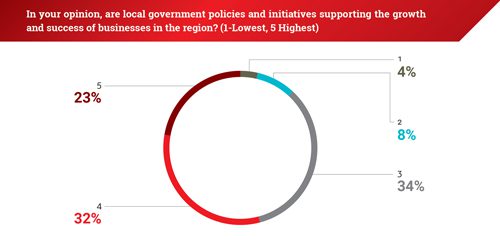

The collective survey responses reflect continued confidence in the strength of the Southern economy, despite a general trend of growing uncertainty. This is reflected in the ‘moderate’ ranking of the local government’s performance in supporting businesses in the region today, which received an average grade of 3.66 — a notable decrease from 3.93 in 3Q24.

“We’ve observed growing optimism in the market following the recent rate reductions. These adjustments give investors more confidence …which leads to an influx of equity and capital into the market…Despite economic pressures, the region remains a highly attractive market for new residents, investment and businesses,” a global real estate services firm’s Miami-based managing director told Invest:.

For more CABSS reports, click here.