Writer: Ryan Gandolfo

April 2024 – In the first quarter of 2024, the latest Capital Analytics Business Sentiment Survey (CABSS) revealed a generally positive outlook for businesses and local economies in the United States.

April 2024 – In the first quarter of 2024, the latest Capital Analytics Business Sentiment Survey (CABSS) revealed a generally positive outlook for businesses and local economies in the United States.

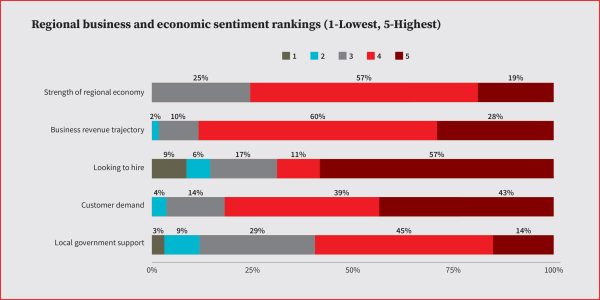

In survey responses from public and private sector leaders in markets covered by Capital Analytics’ annual economic reports, from January 2024 through March 2024, market leaders ranked the strength of their regional economy 4.03 out of 5 (5 being the highest), on average. The new figure represents a positive shift from the previous quarter as business leaders are showing more optimism in recent months. Southern market leaders held more favorable views, with 77% of respondents ranking their area economy 4 or 5, while 60% of Northern market leaders shared the same positive sentiment. Both indicators are higher than last quarter in part to growing confidence that inflation will continue softening in 2024.

“Celebrating is a key trend we’re seeing with people wanting to have family reunions, bachelorette parties, and events. … People want value but high quality,” said a tourism executive in Pennsylvania. U.S. consumer sentiment hit a two-plus year peak in March 2024, according to the University of Michigan’s benchmark Consumer Sentiment Index. Slowing inflation has played a part as expectations for inflation over a one-year horizon have declined to under 3%.

The majority of Northern leaders who participated in the CABSS 1Q24 survey expressed a positive viewpoint regarding the current strength of their regional economy, with 75% ranking their area economies 4 or 5.

In terms of business revenue trajectory, both Northern and Southern market leaders expressed overall positive sentiment, with 84% and 96% respectively, ranking projected revenues in the coming six months at 4 or higher. While still high, overall sentiment for the southern market revenue trajectory fell 5% compared to 4Q23.

“Our strategy involves evolving and diversifying our revenue streams beyond traditional banking products and exploring banking products that differentiate us and drive non-interest income,” a San Antonio-based bank executive told Invest:.

For a banking industry that experienced a tumultuous 2023 with interest rate hikes, bank failures, and deposit declines, diversifying revenue streams through banking-as-a-service (BaaS) could present new opportunities to generate fees from additional services like fraud management, ACH, card issuing and processing. Total BaaS revenue is projected to increase from nearly $7 billion in 2023 to $25.5 billion in 2026, according to Cornerstone Advisors.

On the hiring front, decision-makers have expressed greater labor needs, with 77% of survey respondents in Southern markets ranking hiring expectations over the next six months at 4 or higher, compared to 68% in Northern markets.

Demand for products and services in both Northern and Southern markets continues to be strong, with 82% and 90% of respondents ranking their demand at 4 or higher, respectively. For businesses, that translates to new investment.

“In order to accommodate additional traffic and demand, we are working to extend our primary runway,” said a Texas aviation company president. “Because we are a reliever airport to two fast-growing airports, we are a high priority for federal funds from the Federal Aviation Administration (FAA). We are fortunate that the FAA sees value in the investment in airports like ours.”

On local government support, Northern and Southern market leaders each expressed overall greater optimism, as the majority of respondents (63%) in Southern markets ranked support at a 4 or higher while Northern market leaders’ positive sentiment (59%) rose significantly from last quarter.

For an in-depth analysis of CABSS 1Q24 findings, read our Northern and Southern reports.