Writer: Pablo Marquez

October 2024 — According to the latest Capital Analytics Business Sentiment Survey (CABS), business leaders in the Southern markets covered by Capital Analytics continue to express a positive outlook on the local economy. Survey respondents across multiple industries and sectors have shown continued trust and confidence in their respective business environments, albeit hyper aware of potential challenges such as market volatility, regulatory changes, and evolving consumer preferences that could impact future growth and stability.

October 2024 — According to the latest Capital Analytics Business Sentiment Survey (CABS), business leaders in the Southern markets covered by Capital Analytics continue to express a positive outlook on the local economy. Survey respondents across multiple industries and sectors have shown continued trust and confidence in their respective business environments, albeit hyper aware of potential challenges such as market volatility, regulatory changes, and evolving consumer preferences that could impact future growth and stability.

The 100-plus leaders who participated rated their business sentiment and ranked all questions on a scale from 1 being the lowest to 5 being the highest scores, respectively. Overall, responses on the 3Q24 survey showed slight improvements and similar results compared to the survey that was conducted in 2Q24.

General economic economic indicators in the U.S. economy suggest that there is a good case for optimism. According to the Organization for Economic Co-operation and Development (OECD), the unemployment rate in the United States remains low and stable at 4.2% as of July 2024. The Federal Reserve’s recent interest rate cut has led to a stable yet softening environment where the U.S. job market is seeing an increase in the number of jobs available. The Federal Open Market Committee (FOMC) members voted to set the rate at 5%, with a previous rate of 5.5% and a forecast of 5.25%. There has only been a slight increase in unemployment and layoffs recently that is not projected to increase substantially in the near future. The U.S. job market has shown little sign of deterioration at the moment. Meanwhile as of August 2024, the inflation rate is at one of its lower points in the year at 2.5%. In fact, the annual inflation rate in the U.S. has slowed for the fifth consecutive month, reaching its lowest point since February 2021 and falling below projections of 2.6% that were predicted by the PCE index.

“Over the past two years, the market has slowed due to high interest rates, but we still see strong interest from investors in Jacksonville’s single-family properties, driven by the strength of the market and the single-family sector,” said a Jacksonville based real estate professional. “We are still facing some headwinds. We call it the three I’s: interest rates, insurance, and inflation. These factors have been problematic for a while now, but we think they will start cooling off soon,” voiced another real estate business leader in Northeast Florida.

In 3Q24, 89% of respondents considered the regional economy to be strong at the moment, an increase of 1% compared to 2Q24. Meanwhile, 10% of respondents took a neutral view, and 1% had a negative stance, demonstrating a minimal change from 2Q24 where respondents ranked 12% neutral and 0% negative. The overall 3Q24 score for the strength of the regional economy today was 4.22 out of 5, virtually the same from 4.21 in 2Q24.

Overall, Southern market respondents expressed a general sense of positive business sentiment in part due to the strength of their metro areas.

“Charlotte is booming, it is a fantastic place to live, work and play. This year Charlotte ranked as the third fastest-growing city in the country after Dallas and San Antonio,” said an engineering and architecture leader in Charlotte. “Charlotte is the second-largest banking city in the United States behind New York. It’s an attractive place to live, which has led to significant migration into the city and state,” added another Charlotte-based banking industry expert.

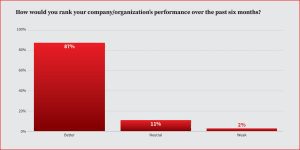

In terms of perceived company performance in the last six months, 87% of 3Q24 respondents felt their companies were performing at a high level. Simultaneously, 11% saw company performance neutral and 2% in a negative manner. The 3Q24 total score for leaders ranking their company’s performance in the last six months was 4.34 out of 5.

From universities to law firms, the higher scores indicate stronger demand. “We’ve had our sixth straight year of record enrollment, which is quite impressive. We’ve nearly tripled our total enrollment and quadrupled the number of resident students,” said a leader from the education industry in Miami. “We have exceeded record revenues each year for the past few years, and I think this year in particular is going to be another record-breaking year for us,” said a leader from the legal industry in Jacksonville.

The percentage of decision-makers surveyed in 3Q24 who are looking to hire more workers in the next six months was 80%, an 11% increase compared to the 69% in 2Q24. The 3Q24 added score for the likelihood of companies hiring more employees in the next six months was 4.31 out of 5, increasing from 4.02 in 2Q24.

“Our success as an accounting firm is defined by the talent that we hire, so we spend a lot of time and effort in recruitment and workforce development programs. We know that we compete in an international job hiring market, and we do our best to recruit the best talent available based on the current demands that potential hires are looking for. The real challenge in Orlando is the availability of great talent and being able to hire it. There are many talented individuals in Orlando that could work for accounting firms like ours, and we spend a lot of time and effort trying to recruit them,” a Central Florida-based accounting leader told Capital Analytics.

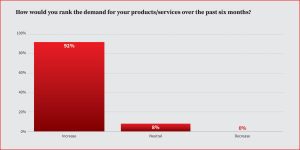

Demand has remained strong this past quarter, with 92% of 3Q24 respondents expressing greater demand for their services over the last six months, while 8% remained neutral and none expressed a decrease in demand. Comparatively, 2Q24 data showed 85% of respondents perceived an increase in demand, 9% remained neutral, and 6% indicated a decrease.The combined score for 3Q24 of companies ranking the demand for their services in the last six months was 4.59 out of 5, increasing from 4.40 in 2Q24.

Business leaders across multiple industries in the Southern Markets have highlighted the role of population growth and business relocations as a key factor in driving the demand for their services in recent months.

“Atlanta, like many other Southeastern cities, continues to benefit from strong population and job growth, which are great underlying fundamentals”, an Atlanta real estate leader told Capital Analytics.

The majority of respondents expressed that the local government policies and initiatives were supporting the growth and success of businesses in the region. In 3Q24, 70% of respondents ranked local government support at a 4 or higher, while 21% placed support at a 3, and 9% at a 2 or lower. Survey results were largely unchanged from the 2Q24 survey.

For more CABS reports, click here.