Writer: Ryan Gandolfo

October 2023 — The past quarter of economic activity has ensured at least one consistent theme across U.S. Southern markets: uncertainty.

October 2023 — The past quarter of economic activity has ensured at least one consistent theme across U.S. Southern markets: uncertainty.

Yet, with an expected final projected interest rate hike by the U.S. Federal Reserve later this year, moderating levels of inflation, higher oil prices and a slowing of new construction projects coming online, leaders in the U.S. Southern markets are still fairly upbeat about near-term future projections and overall business sentiment.

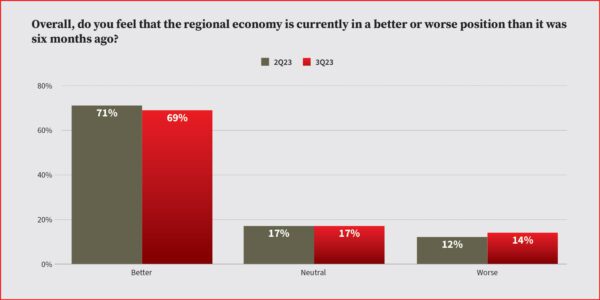

In survey responses gathered from 200-plus market public and private sector leaders in the Southern markets covered by Capital Analytics’ annual business reviews, over the July 2023 to September 2023 period, the Capital Analytics Business Sentiment Survey (CABSS) in 3Q23 found overall business sentiment relatively unchanged from the previous quarter. Compared to 2Q23, this past quarter showed a slight dip in regional economy sentiment, from 71% to 69%. Leaders with a neutral viewpoint remained the same as last quarter, while there was a 2% increase among those who viewed their regional economy in a negative direction.

“We’re in a healthy market that is growing with thousands of people moving in and a lot of jobs relocating here,” a global commercial real estate lender operating in Texas and several U.S. markets told Capital Analytics. Overall trends from an earlier domestic migration analysis by Bank of America Institute in June 2023 found metropolitan statistical areas like Austin, Tampa, Orlando and Phoenix leading the country in population growth from 2020 to 2023.

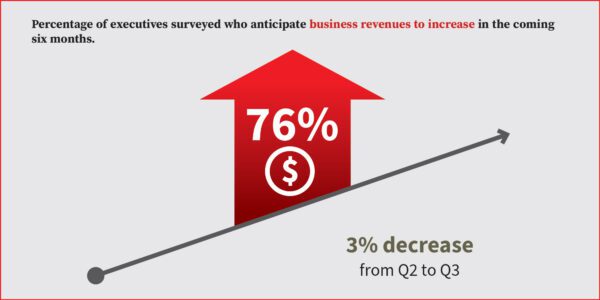

From a revenue standpoint, businesses are still anticipating growing their earnings in the coming six months in Southern markets; however, there has been a drop-off, from 79% last quarter to 76% in 3Q23.

“The current interest rate environment is challenging, yet we continue to grow our deposits, partly due to being relatively new in larger metropolitan markets, allowing us to share our compelling story. Managing net interest margin and staying competitive have been significant challenges but our leadership team is focused on supporting clients and concentrating on the long-term outlook, especially for the second half of 2024,” a Mid-Atlantic-based bank told Capital Analytics last quarter.

One constant from quarter to quarter has been the need for talent, with 70% of respondents looking to hire more workers in the next six months, unchanged from 2Q23.

“The top challenge we are having, much like the rest of the country, is still the workforce. We saw around a 15% increase over the past year but have not met our pre-pandemic numbers yet. We are addressing this on three different levels, including the local level. We received $1.5 million from our county for workforce development and the creation of programs that make it easier for residents to get access to job availability and to educate them on the available opportunities,” said a North Carolina-based tourism organization, which mentioned its focus on working with government to generate more work visas for international workers to support critical industries, such as agriculture and construction. On July 31, the Department of Homeland Security announced an increase to the number of available work visas, with nearly 65,000 additional H-2B visas for temporary nonagricultural workers made available.

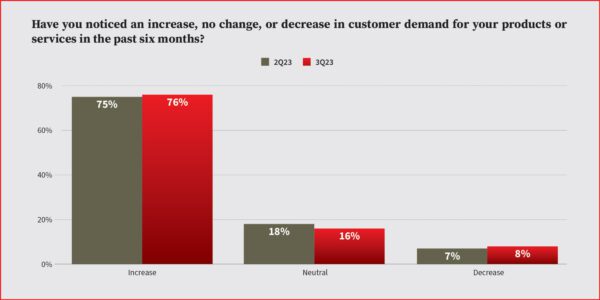

On the demand front, companies and organizations are continuing to meet the needs of more customers, with overall demand from survey respondents rising slightly in 3Q23, from 75% last quarter to 76% this quarter. While industries are seeing a dip in sales and earnings due to interest rates and other factors, Southern leaders have noted their markets remain resilient due to business attraction. “The good news is we are the yachting capital of the world and equally important — people want to be here for business and lifestyle,” a Fort Lauderdale marine organization CEO told Capital Analytics.

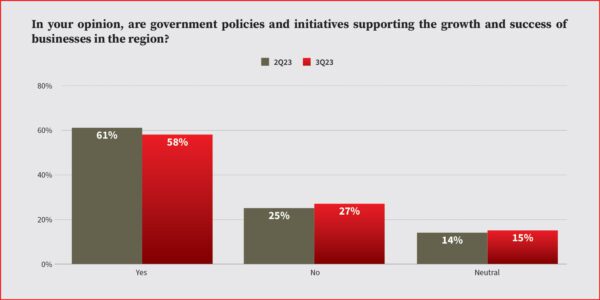

Perhaps the most noticeable difference from last quarter to now has been business and organization leaders’ perspective on government support for business success in regional economies. In 3Q23, 58% of respondents felt government policies and initiatives supported business growth, a 3% decrease from the previous quarter. One area of focus that may require government intervention is property insurance — with states like Florida feeling the brunt of premium increases while Florida insurers have seen a dramatic shift from profit to net losses.

“All businesses are in a liquidity crisis, but particularly in the insurance industry,” a Florida-based commercial real estate firm told Capital Analytics. “On the reinsurance side, there’s just not enough money for the demand of risk. You see the same total insurable value of the property with substantially worse coverage at a 60% increase in premium. In some cases we’re seeing 300% increases in premium, and that’s if you can even get it. If we have a major catastrophic event, there is no liquidity to make all of those payments. If you own property in Florida and are not having problems or accounting for that, you need to be. The No. 1 issue facing real estate in Florida isn’t interest rates, construction costs, or population migration. It’s insurance.”

For comprehensive business intelligence reports on 20 U.S. markets, click here to register.