Writer: Mirella Franzese

April 2025 — Business sentiment in the U.S. South declined in the first quarter of 2025 amid broader uncertainty introduced by political and economic changes, according to caa’s Invest: business sentiment survey (I:BSS).

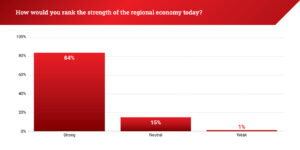

Eighty-four percent of Southern respondents rated their regional economy as “strong” in 1Q25 — a 4% increase from 4Q24.

Leaders cited population growth, strategic location, and access to talent as key indicators for regional growth in the near-term.

“One of the advantages we have here is the city’s strong industrial base, particularly in energy…We also benefit from Texas’ strong education system. The state’s universities and community colleges produce top-tier engineers and technicians,” said a Houston-based aerospace leader.

“We are in a market favoring labor, so there is more opportunity for people than ever,” echoed an official in Central Texas.

Executives adopted a wait-and-see approach to the new administration’s trade and immigration policies, with manufacturers and builders among the most affected.

“Texas has been the No. 1 exporting state for 23 consecutive years, with key exports like oil, gas, industrial equipment, and even agricultural goods like cotton. Most people don’t realize how essential…trade is to everyday life — 100% of the cell phones in our pockets, 100% of the bananas we consume, and 97% of the clothes on our backs arrive by ship,” a Texas-based education leader told Invest:.

Respondents highlighted that a reliance on imports and a shortage of domestic processing capacity for construction materials (such as lumber and aluminum) would prove challenging for the construction industry as whole, but said federal deregulation under the new administration would benefit homebuilders, easing some of the regulatory constraints.

Regional leaders also conveyed diminishing optimism on the hiring front, as the percentage of executives likely to expand their workforce decreased by 5% from 4Q24.

Meanwhile, 84% of Southern respondents said that demand for their organization’s products and services was ‘strong’ — a 4% dip from the previous quarter’s response which points to decreased consumption and buyer spending as a result of broader market uncertainties.

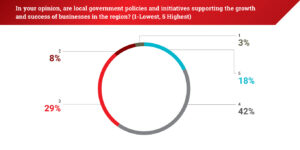

Confidence in the local government’s ability to support local businesses was more evenly split, with six in 10 (60%) industry leaders ranking 4 or 5 out of 5, while the remaining 40% opted on 3 or lower.

The responses reflect an anticipated resilience of the Southern U.S. economy even in the face of macroeconomic headwinds across industries.

“[We] remain cautiously optimistic. Business clients are hopeful for a more moderate regulatory environment, but we’re watching risks — especially tariffs, which have been discussed but not fully implemented, “ said a South Florida finance executive. “This is not 2008 or 2009…While volatility will continue, we still see a positive long-term trajectory.”

For more I:BSS reports, click here.