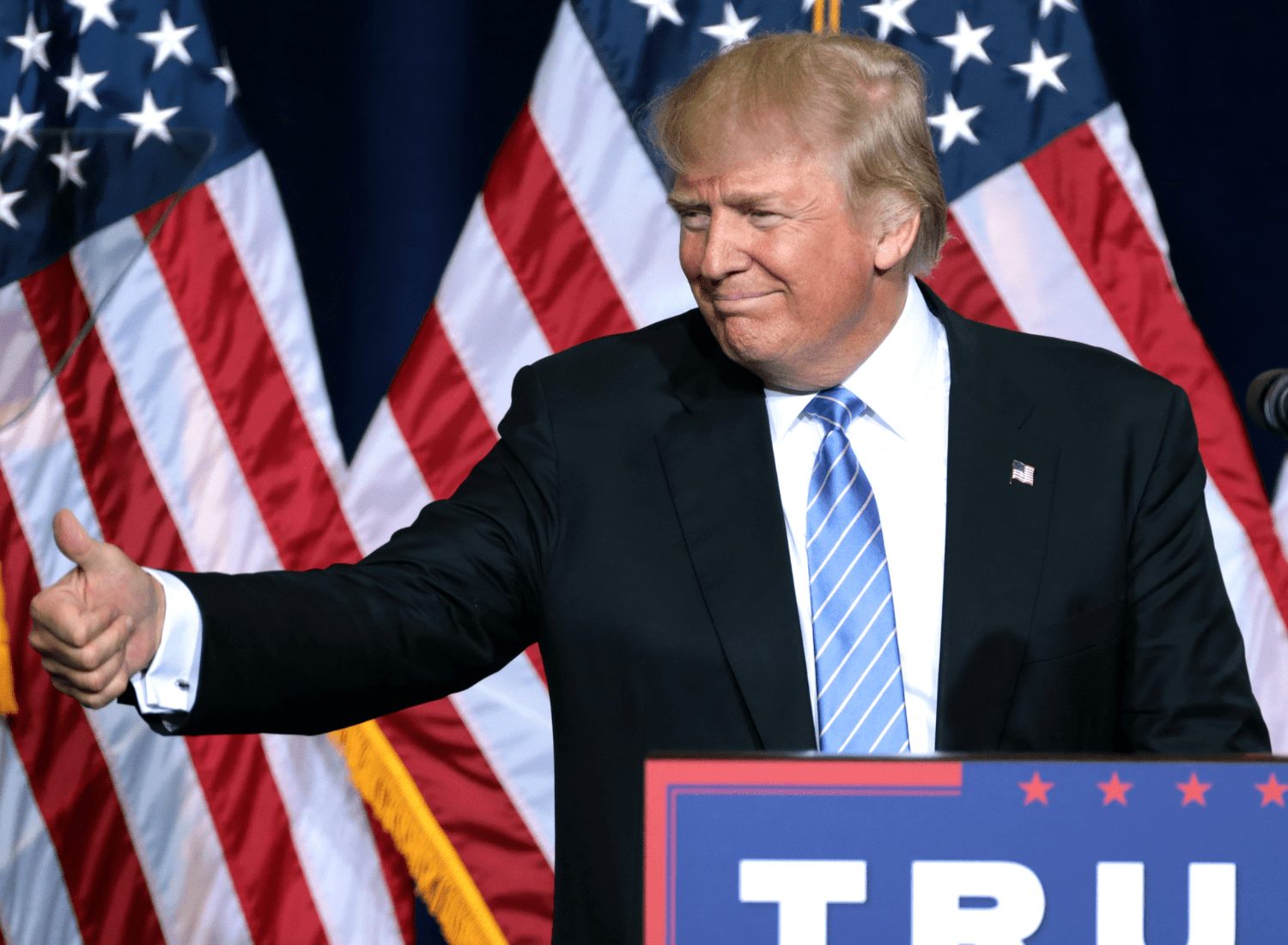

Trump 2.0: Businesses prepare for second Trump term

Writer: Ryan Gandolfo

2 min read January 2025 — While a familiar, controversial face returns to the White House on inauguration day, the U.S. economy and businesses have changed greatly. From inflation leading to higher interest rates to an increasingly volatile global trade environment, businesses are confronted with a set of challenges more complex than eight years ago — and President Donald Trump’s second term will hinge on successfully solving those challenges.

2 min read January 2025 — While a familiar, controversial face returns to the White House on inauguration day, the U.S. economy and businesses have changed greatly. From inflation leading to higher interest rates to an increasingly volatile global trade environment, businesses are confronted with a set of challenges more complex than eight years ago — and President Donald Trump’s second term will hinge on successfully solving those challenges.

“There was the overhang of the election, but now that it’s over we anticipate the impact on the market will be significant,” Kevin Scanlon, executive vice president and head of private wealth management at Stephens Inc., told Invest:.

The S&P 500 has increased 3.7% between election day (Nov. 5, 2024) and last Friday (Jan. 17); however, recent post-election market data shows the benchmark index averaged a 31.2% return over 12 months after the last three elections (2020, 2016, and 2012).

Despite a degree of uncertainty, U.S. businesses overall feel good about their regional economy, with more than 3 in 4 business leaders (76%) ranking their regional economy three or higher (out of five) in the latest quarterly Capital Analytics’ Business Sentiment Survey (CABSS).

READ MORE: CABSS: Business sentiment ‘optimistic’ heading into 2025

During his first presidency, Trump unveiled the 2017 Tax Cuts and Jobs Act (TCJA), which changed deductions, depreciation, expensing, and tax credits, among other items affecting businesses. Set to expire at the end of 2025, Trump has supported making some of the provisions permanent. “Although the Republicans taking the majority in the Senate and the House may increase the likelihood of extending provisions under the TCJA, it may be late into 2025, or even early 2026, before there is any certainty,” wrote Joshua Headley and other contributors in a November 2025 article on national law firm Buchanan Ingersoll & Rooney’s website.

To offset the cost of tax cuts, Trump has proposed significant import tariffs, including a universal 10-20% tariff on all imports. Additionally, Trump has expressed his intention to raise the tariff on imports from mainland China to 60% — a notable shift from the current weighted-average tariff rate of about 10%. A similar stance has been made on Mexican-made goods, with the president threatening a 100% tariff, which could throw a wrench in the trade deal he made with the southern neighbor during his first term, Inc. reported.

Estimated effects of Trump’s tariff changes would lead to a 1.7% reduction in GDP, factoring in potential foreign retaliation to U.S. imposed tariffs. A 2023 International Monetary Fund Working Paper found that larger countries have a tendency to retaliate more, particularly during periods of higher unemployment. (European Union unemployment was at 5.9% in November 2024, trending significantly lower over the past decade.)

READ MORE: What a second Trump presidency means for U.S. businesses

A 4Q24 survey by the National Association of Manufacturers found that 70.9% of manufacturers feel positive about their company’s outlook — an 8% jump from the previous quarter. A second Trump term could see a continued emphasis on reshoring efforts, potentially stimulating domestic manufacturing growth.

On the inflation front, a central theme of Trump’s 2024 electoral campaign, the economic indicator has edged higher in recent months, with overall inflation at 2.9% in December 2024. While inflation has fallen significantly since peaking at 9.1% in June 2022, the Federal Reserve is expected to make fewer interest rate cuts in 2025 due to sticky inflationary pressure.

Meanwhile, the purchasing power of American households has seen solid gains, according to the Bureau of Labor Statistics. In 3Q24, median weekly real earnings rose by 0.8%. The U.S. Department of the Treasury noted, “the median American worker could afford the same goods and services as they did in 2019, plus an additional $1,600 to spend or save per year.”

“We don’t know exactly what will happen and when, but there will be changes. That said, I’m confident our team will continue to adjust and adapt,” said Scanlon.

Image via Gage Skidmore/Wikimedia

For more information, please visit:

https://www.bipc.com/

https://home.treasury.gov/

https://nam.org/

https://www.stephens.com/