Industry corner: Business leaders on best practices driving organizations forward

Industry corner is a monthly series on what company leaders believe are the most important best practices in their sector or organization to ensure growth and sustainable success.

Industry corner is a monthly series on what company leaders believe are the most important best practices in their sector or organization to ensure growth and sustainable success.

June 2025 — From digital automation to AI-powered workflows, embedded finance, and green supply chain, U.S. business leaders from across all sectors are leveraging emerging technologies to drive scalable growth and sustainability while addressing industry-specific challenges.

“Technology is a key enabler,” Mike Balter, managing director of CBIZ, told Invest:. “It’s not just about artificial intelligence, although that’s a part of it. It’s about leveraging tools to make processes more efficient and effective.”

Among the sectors where technologies like AI are rapidly reshaping the traditional environment is the professional services industry, as legal and accounting firms focus on improving operational efficiency, knowledge management, and personalizing client engagement — all while maintaining transparency and ethical use. The integration of AI into legal research databases, for instance, makes retrieval of information more efficient, which streamlines workflows, according to Telese Zuberer, president of Icard Merrill, a Florida-based full-service law firm.

However, only 38% of professional service employees currently use Gen-AI tools, according to a recent survey from Boston Consulting Group (BCG). While AI adoption across the board remains a challenge, primarily due to lack of access or know-how, Icard Merrill is addressing the need for agile data recovery by embedding AI tools into its corporate software, signaling a major turning point in how law firms operate and engage with virtual platforms.

“While our firm is not aiming to be at the cutting edge of technology, we strive to stay just behind it,” said Zuberer about the rise of AI. “This approach ensures we adopt tools that are both effective and safe for our clients, while still advancing in areas like mobility.”

The modern digital economy is also transforming how financial players interact with customers. Embedded finance — the seamless integration of payment or lending solutions within non-financial platforms — and the growth of fintech-bank partnerships are changing the landscape and fast. The global embedded finance market is projected to reach $7.2 trillion by 2030, according to a report by Dealroom and ABN AMRO Ventures, which highlights its growing impact in revolutionizing financial ecosystems.

“Rather than competing with fintech, we integrate it into our operations to serve clients better,” explained Stephanie Green, South Florida region president of Fifth Third Bank, in an interview with Invest:. “Our approach is simple — if a fintech solution enhances the client experience, we seek to partner with or acquire it. Technology is reshaping banking, and we are committed to integrating the best solutions to expand and improve our offerings.”

While fintechs are notably nimbler and more agile, banks leverage reputation, access to capital, and broad breadth of services, which makes partnerships between the two that much more efficient in an increasingly digital and diversified economic landscape, according to a new report by the World Economic Forum. “Beyond large-scale financial deals, the most meaningful transformation lies in accessibility,” explained the study. “This increased accessibility has enabled participation in the modern digital economy and driven a rise in digital financial literacy that is organic and impactful.”

Eds and meds

Similar to the financial and professional services sector, U.S. health systems remain on the cutting edge of the digital revolution, integrating AI tools beyond telemedicine to enhance diagnostics, workflow automation, and patient outcomes. One of the Nation’s Best Hospitals according to the US News & World Report, Tampa General Hospital (TGH), is embedding AI into its in-house operating system to deliver personalized experiences to each patient at scale, representing a paradigm shift in the traditional model of care; while most healthcare systems are built around the needs of the system, TGH is structuring its practice around the needs of the patient. “If we can solve the puzzle of coordinating care for our patients and our team, we will position ourselves to continue improving our community’s health, despite the challenges ahead for healthcare systems,” said Pete Chang, senior vice president and chief transformation officer at Tampa General Hospital in a recent conversation with Invest:.

In collaboration with big data software developer, Palantir Technologies, TGH is leveraging AI to build a centralized health system, leading to reduced patient hold times in the Post-Anesthesia Care Unit (PACU), enhanced nurse staffing ratio, increased accuracy in its PACU predictive model, and a major reduction in time spent managing patient placements, in addition to faster real-time disaster response. “Our relationship with Palantir is one of the most important partnerships to enhance our future in health care transformation. Scale and personalization are the two largest challenges ahead of us. We must be able to automate simple tasks that currently consume the daily work of our fantastic team, allowing us to scale,” added Chang.

Along those same lines, AI continues to reshape the education industry as innovation is enhancing personalized learning without comprising student-teacher relationships at Pasco-Hernandez State College in Tampa Bay. ”AI can help us improve how we operate as a college,” Former President Jesse Pisors told Invest:. “We collect an enormous amount of student data every year — grades, performance on individual assignments, attendance patterns — and AI can analyze that data in ways that simply exceed our capacity as humans.”

This newfound use of the technology allows teachers to pinpoint areas where students are struggling, eliminate course schedules with lower success rates, and tailor course modalities to different student profiles, improving all-around decision-making. Although the advancement of AI is not without its challenges in the classroom. Academic integrity, for one, remains a major obstacle. “We still need students to develop real skills. If a student is preparing for an engineering career, for example, they need to actually understand the calculations they are doing, and AI doing their homework for them will deprive them of that understanding … We must ensure that learning remains authentic.”

Going green

Technology and innovation are also at the forefront in the development of agile and green supply chain operations, which remains top-of-mind for logistics and infrastructure corporations, in particular, as they target net-zero. Investments in AI-driven logistics, regionalized supply networks, and eco-friendly transportation have become integral for driving long-term sustainability and resilience.

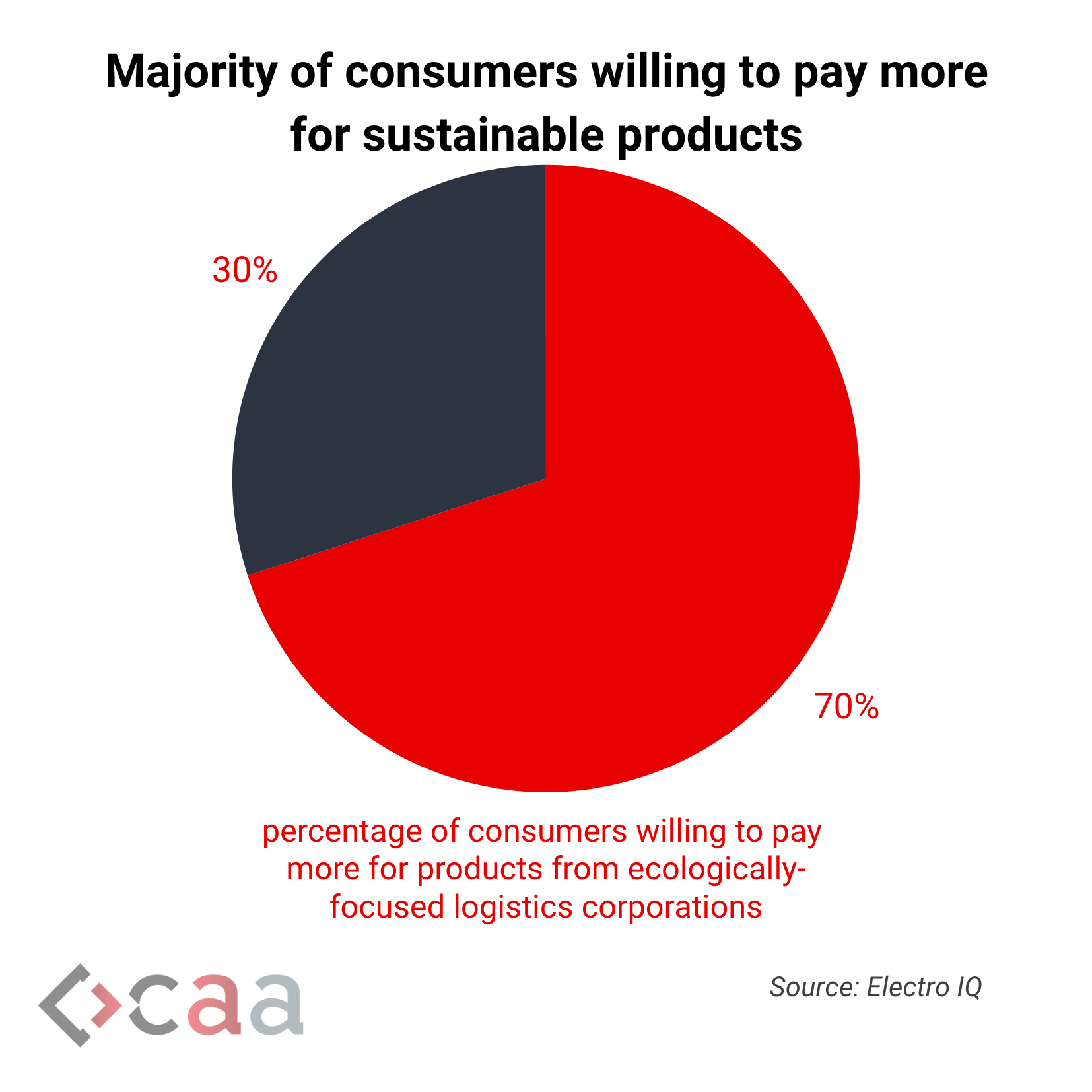

To that end, green supply chain management is the key toward achieving profitability, compliance, and resilience in 2025 and beyond, as emissions remain under close governmental scrutiny and extreme weather events disrupt distribution. Demand for sustainable supply chain operations is increasing as well with nearly 70% of consumers willing to pay more for products from ecologically-focused logistics corporations. Investments in water infrastructure, renewable energy, energy storage, clean transportation systems, and supply chain resilience continue to play a major role in shaping the long-term outlook, according to John Beckham, managing director of the San Antonio-based North American Development Bank (NADBank), which finances the development and implementation of environmental infrastructure ventures.

For Beckham, NADBank’s most pressing priorities are “water infrastructure for clean, reliable water service, diversifying water sources, and conservation” in addition to “reliable, cheap, and renewable energy that is abundant along the U.S.-Mexico border, and, resiliency of our supply chain for clean and efficient ports of entry and agile transportation.”

Environmental, social, and governance (ESG) and smart buildings are likewise becoming common practice in the real estate industry as developers continue to invest in energy-efficient, tech-enabled properties to attract tenants and investors alike, and facilitate regulatory approval.

“This is not a short-term trend but a long-term evolution,” said Alex Hernandez, president of Hernandez Construction & Development, headquartered in Greater Fort Lauderdale, in an interview with Invest:. “ESG initiatives continue to drive investments, and we remain committed to integrating these principles into our projects. Sustainability and innovation will stay at the forefront of our approach as we adapt to the changing demands of the industry.”

Beyond increasing interest in a project, green office buildings have around 14%-16% more asset value than properties without ESG-certifications, as well as command higher rental premiums, lower vacancy rates, and reduced operating costs, according to data compounded from recent CBRE and EY reports, presented by Exquance.

Tourism businesses, including hotels, are also shifting toward eco-conscious experiences, balancing high-end service with responsible tourism practices as they redefine the guest experience. In this regard, technology and innovation are again leading the charge, particularly when it comes to attracting visitors.

“Technology allows us to stay connected to our target market and reach out to potential vacationers,” said Megan Christianson, executive director of Visit Grand Rapids, in an interview with Invest:.

In addition to reducing costs and emissions, green practices are key to staying relevant and competitive as U.S. consumer preference skews towards eco-friendly. The sustainable trend continues to be seen across the national hospitality and tourism industries as 68% of U.S. tourists currently elect sustainable travel options, according to Global Newswire.

Adoption challenges

Despite the advantages of adopting innovative technologies and sustainable practices, there are also hurdles to overcome. Many business leaders cite cost and the hesitancy of older generations as roadblocks to the full implementation and integration of technology and sustainability across business practices.

Industries like legal and accounting have a long-standing reputation for being slow adopters, although that is changing. Education and healthcare on the other hand, are among the industries going all-in, recognizing that the status quo is no longer possible in a rapidly changing business environment. As newer generations move into leadership roles, adoption will likely accelerate.

While some sectors are moving faster than others, the writing is on the wall, despite the challenges.

“Embracing and understanding new technology is the most significant challenge — and also the most significant opportunity,” Sheri Fiske Schultz, managing partner at Florida accounting and advisory firm Fiske, told Invest:. “Firms that fail to adopt these advancements risk falling behind.”

For more information, visit:

https://buildwithhernandez.com/

WRITTEN BY